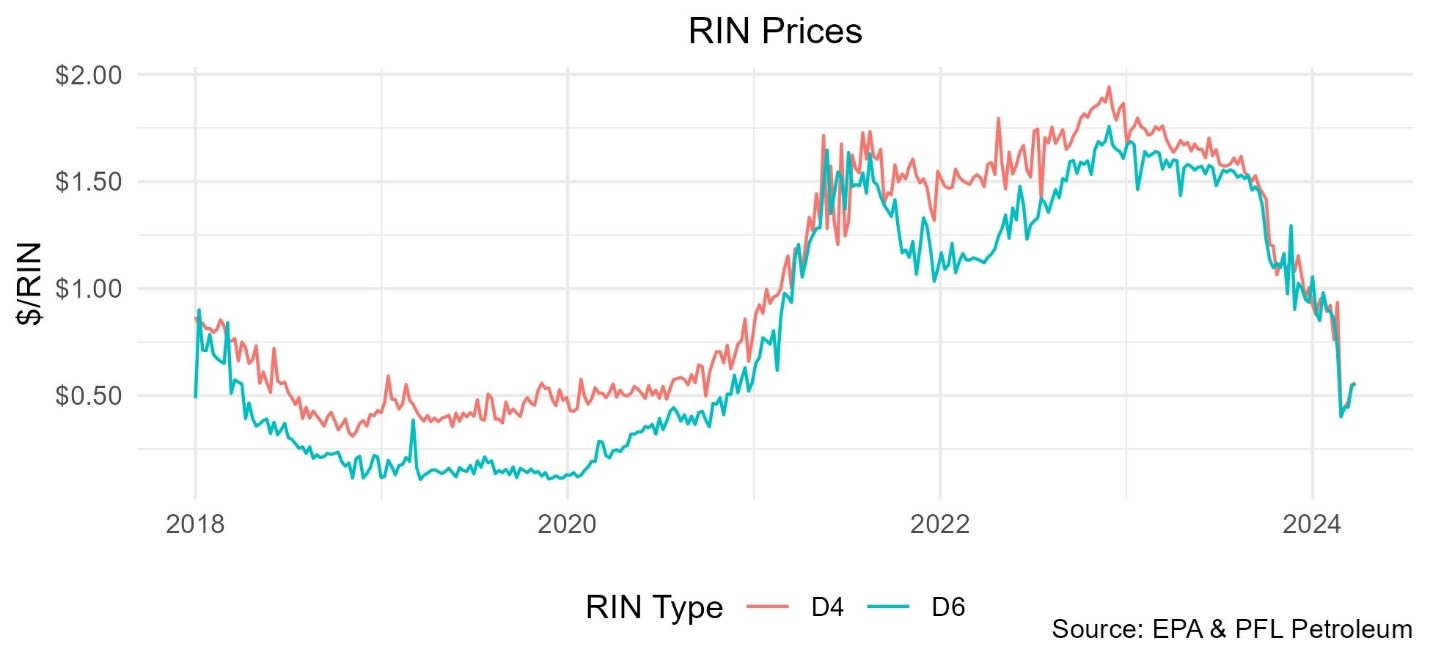

Current RIN Prices

RIN prices have come down significantly in the last 9 months (Figure 1). The decline began around the time EPA published their RFS volume targets for 2023-25 on July 12, 2023. According to PFL Petroleum’s March 25 report, D4 and D6 RIN prices closed at $0.56/RIN and $0.555/RIN respectively. This is a large drop from the prices over $1.50/RIN seen a year ago.

To be competitive, biofuel producers need to be able to sell their fuels at the same price as conventional petroleum fuels. Typically, biofuels have higher costs of production than conventional fuels. RIN prices provide extra income to biofuel producers, so biofuels can be competitive in the market. Strong RINs price encourages expansion of the biofuels industry while weak RIN prices can cause the industry to contract. For these reasons it is important to understand why RIN prices are falling.

Figure 1. RIN Prices

Why Are Prices Falling

Two major factors that impact RIN prices are:

- Cost of renewable fuel relative to conventional fuel

- Quantity of RINs produced relative to the RFS RVO mandate.

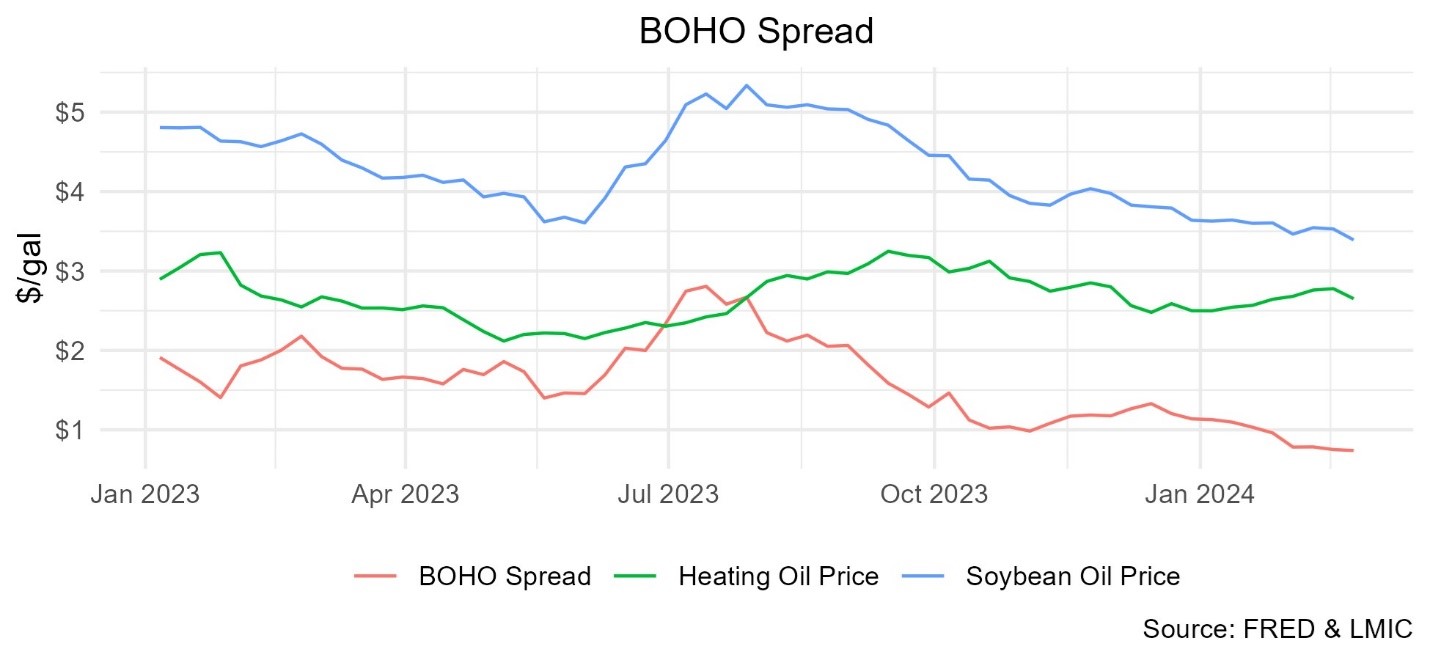

The spread between the soybean oil price and heating oil price (BOHO spread) is commonly used to proxy the relative cost of biomass-based diesel production and conventional fuel production. This ratio has been falling since July 2023. The primary driver has been lower soybean oil prices. This decreasing ratio puts downward pressure on RIN prices. RIN prices falling due to lower feedstock costs should not hurt biofuel producers much because the RIN is simply moving with their cost of production. But as we will see, another factor may be pulling RIN prices down as well.

Figure 2. BOHO Spread

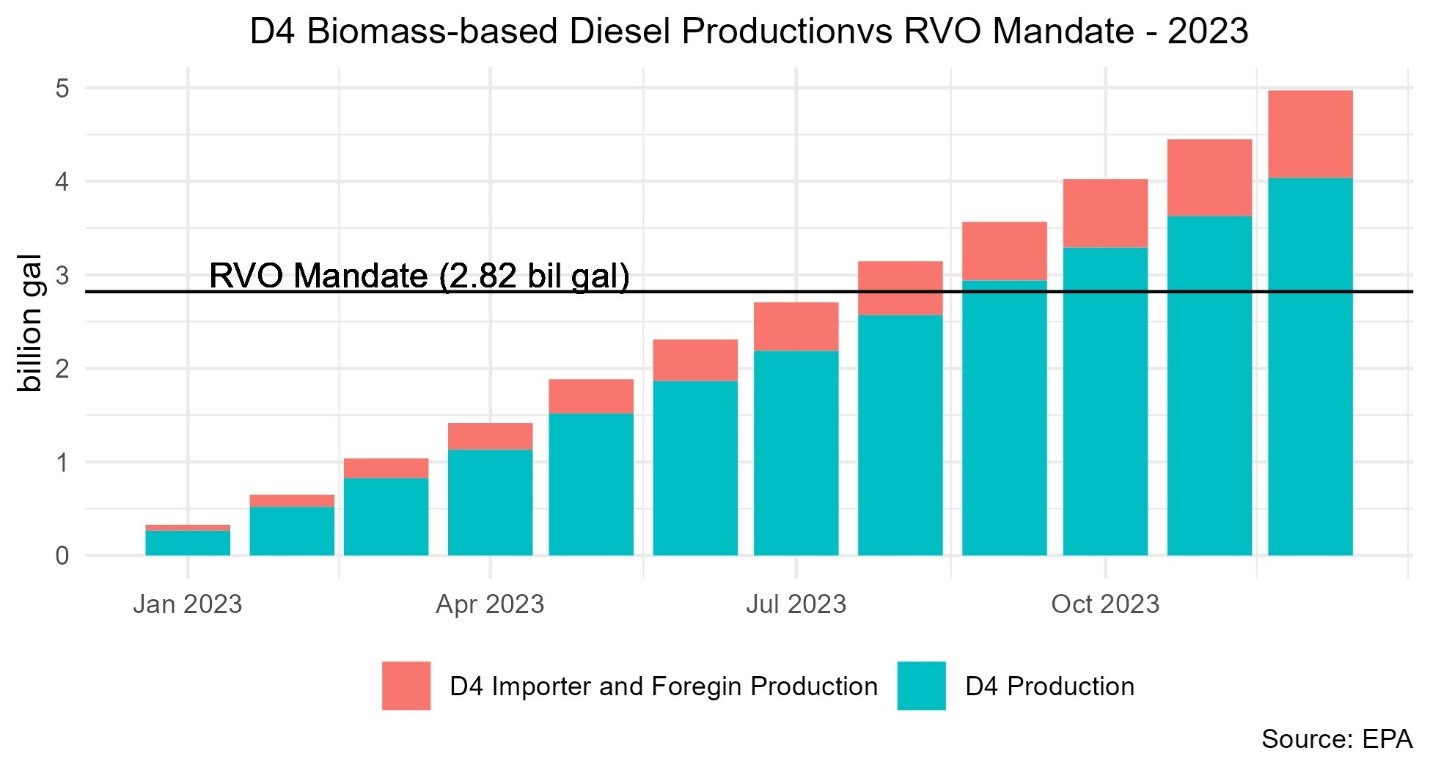

The other major factor contributing to RIN price declines is the oversupply of D4 RINs. When RVOs are set too low, RINs go from a state of scarcity to a state of abundance. If this occurs RIN prices are expected to move toward zero, until production drops far enough so there is no longer an oversupply of RINs.

The D4 RINs generated in 2023 greatly exceeded the 2023 RVO for biomass-based diesel RINs set by EPA (Figure 2). The 2023 RVO was met by August 2023 and exceeded the mandate by 2.15 billion gallons RVO at the end of 2023. A notable share of this fuel is imported/foreign produced. However, domestic production still exceeded the 2023 RVO by the end of 2023.

The 2023 RVO mandate was not finalized until July 12, 2023. This is also around the time RIN prices began moving lower. The market was likely expecting higher RVO mandates given past production levels and announced expansion. Expectations of high RVO’s helped hold RIN prices relatively high leading up to the announcement. When new RVO’s were released much lower than expected, RIN prices began to fall.

Figure 3. D4 Biomass-based Diesel Production vs RVO Mandate – 2023

Looking ahead, the 2024 and 2025 biomass-based diesel RVOs are already set at 3.04 and 3.35 billion gallons respectively. 2023 domestic production already exceeded the 2025 goal, so oversupply is likely to continue. Furthermore, if sustainable aviation fuel and renewable diesel production continue to expand, D4 RIN oversupply will only get worse as production of both fuels generates D4 RINs.

Barring a change to RVOs, the only way RIN prices will increase is if production biomass-based diesel fuel and D4 RINs decreases. The marginal supplier of D4 RINs is thought to be biodiesel (farmdoc, May 24, 2023). If market conditions get bad enough, these will likely be the first to close

References

- Gerveni, M., T. Hubbs and S. Irwin. "Overview of the RIN Compliance System and Pricing of RINs for the U.S. Renewable Fuel Standard." farmdoc daily (13):95, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, May 24, 2023.

- Gerveni, M., T. Hubbs and S. Irwin. "Is the U.S. Renewable Fuel Standard in Danger of Going Over a RIN Cliff?" farmdoc daily (13):99, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, May 31, 2023.

- EPA. Public Data for the Renewable Fuel Standard

- PFL Petroleum (2024). RIN Recap. Reports 2/26/2024 to 3/25/2024.