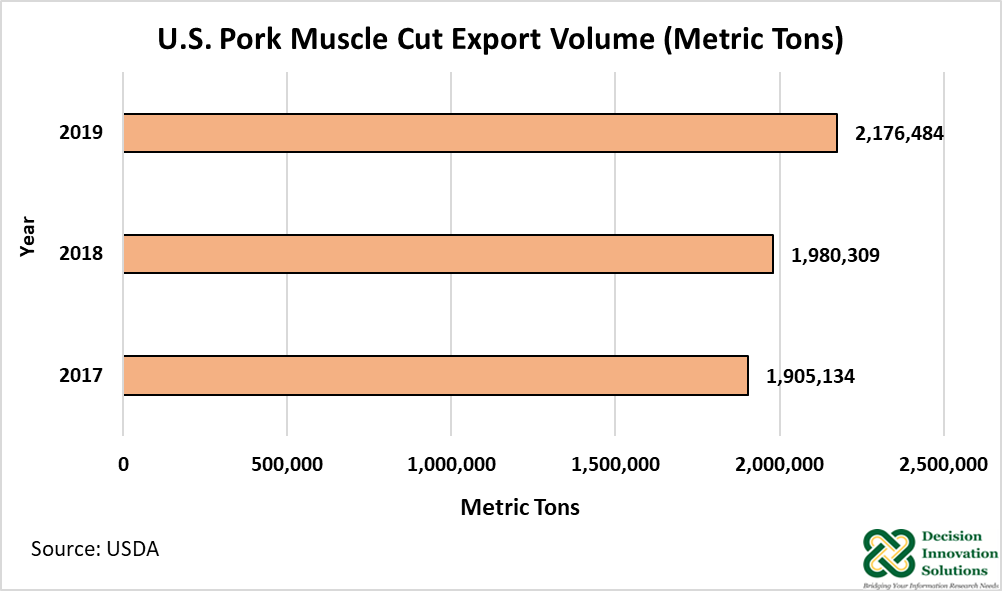

U.S. pork muscle cut1 export volume was up 9% to 2.176 million metric tons (MT) in 2019 compared with 2018 (see Figure 1). 2019 U.S. pork muscle cut exports were boosted by large shipments to China despite high retaliatory tariffs on U.S. pork. China’s drastic swine herd reduction due to the African Swine Fever (ASF) has caused lower Chinese pork production and considerably higher domestic pork prices.

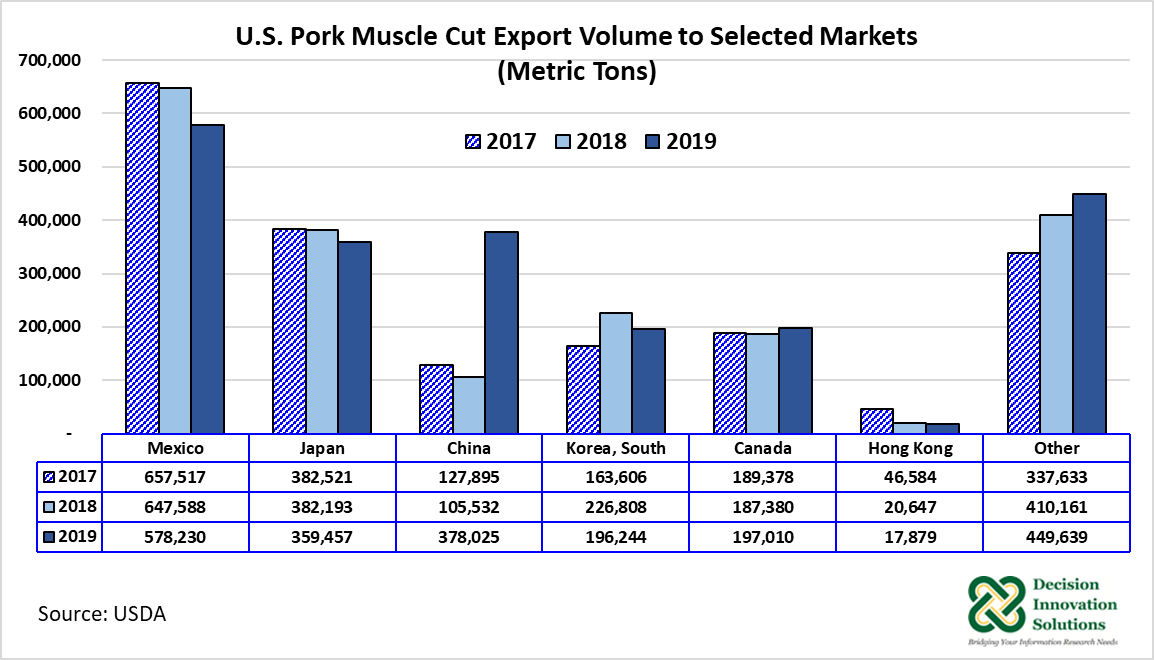

Shipments to China were up 258% to 378,025 MT in 2019 compared with 2018. Mexico continued as the main volume market for U.S. pork muscle cut exports in 2019, while Japan, which has been traditionally the second largest volume market for U.S. pork, fell in third place after China (see Figure 2). 2019 exports to Mexico declined 10.7% to 578,230 year-over-year due to Mexico’s retaliatory tariffs on U.S. pork which stayed in place during the first five months of 2019. Other important markets for U.S. pork muscle cut exports were Canada and South Korea. As Figure 2 show, total exports to the rest of the world were up 10% to 449,639 MT.

2019 U.S. pork muscle cut exports were valued at $5.947 billion, increasing 11% from 2018.

Figure 1, U.S. Pork Muscle Cut Exports

Figure 2, U.S. Pork Muscle Cut Export Volume to Selected Markets (Metric Tons)

Pork Exports During the First 12 Weeks of 2020

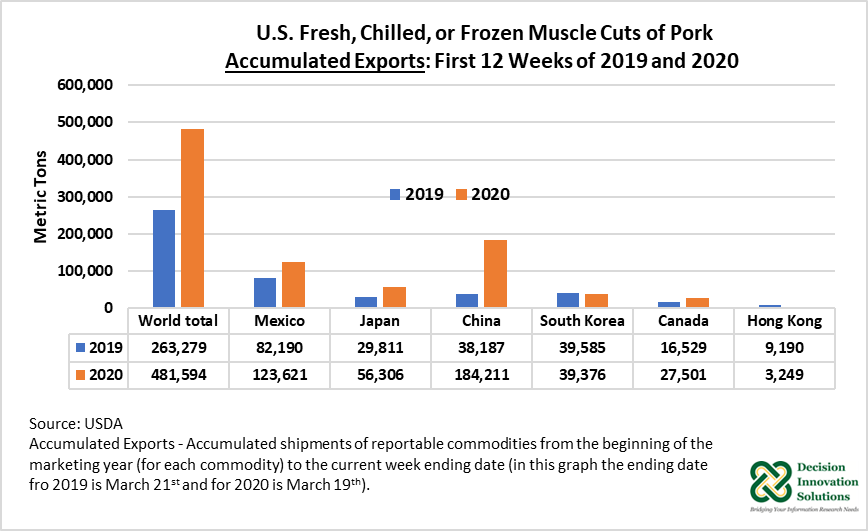

U.S. pork exports reported weekly by USDA are based on exports of U.S. fresh, chilled, or frozen cuts of pork. Total accumulated weekly exports corresponding to the first 12 weeks of the 2020 calendar year (from January 2, 2020 to March 19, 2020), almost double (481,594 MT) compared with the same period in 2019 (see Figure 3). For the first 12 weeks of 2020, U.S. fresh, chilled, or frozen cuts of pork exports to the top five markets expanded in 2020 compared with the same period the previous year. Note that shipments to China surpassed those to Mexico during those first 12 weeks of 2020. It is expected that the negative impact of ASF on China’s pork industry will continue expanding China demand for U.S. pork during the current year.

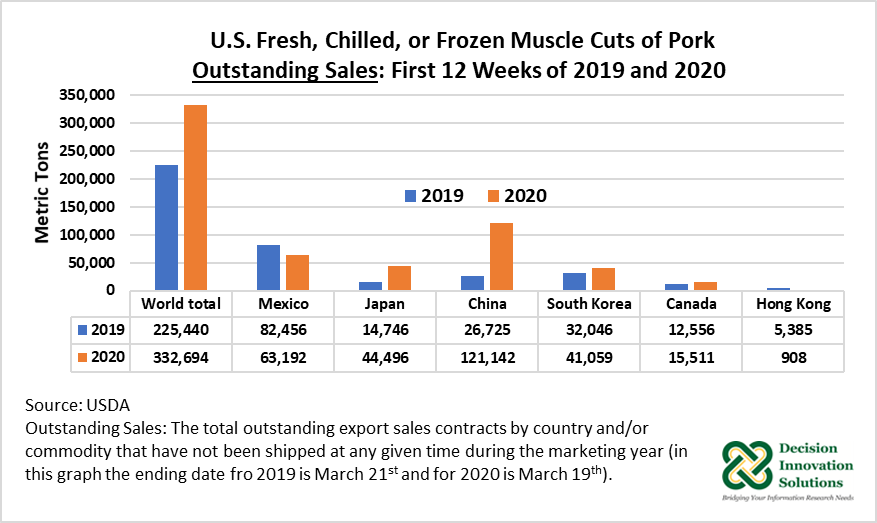

U.S. fresh, chilled, or frozen cuts of pork total outstanding export sales are contracts by countries that have not been shipped at any given time during the marketing year. As of March 19, 2020, U.S. total pork outstanding sales reached a volume of 332,694 MT, up 48% relative to the same period in 2019. By March 19, 2020, China had the largest volume of U.S. pork outstanding sale (121,142 MT) and it was about 4.5 higher than a year earlier. Mexico and Japan held about 19% and 13% of total U.S. Outstanding sales.

Figure 3, Fresh, Chilled, or Frozen Muscle Cuts of Pork Accumulated Exports: First 12 Weeks of 2019 and 2020

Figure 4, U.S. Fresh, Chilled, or Frozen Muscle Cuts of Pork Outstanding Sales: First 12 Weeks of 2019 and 2020

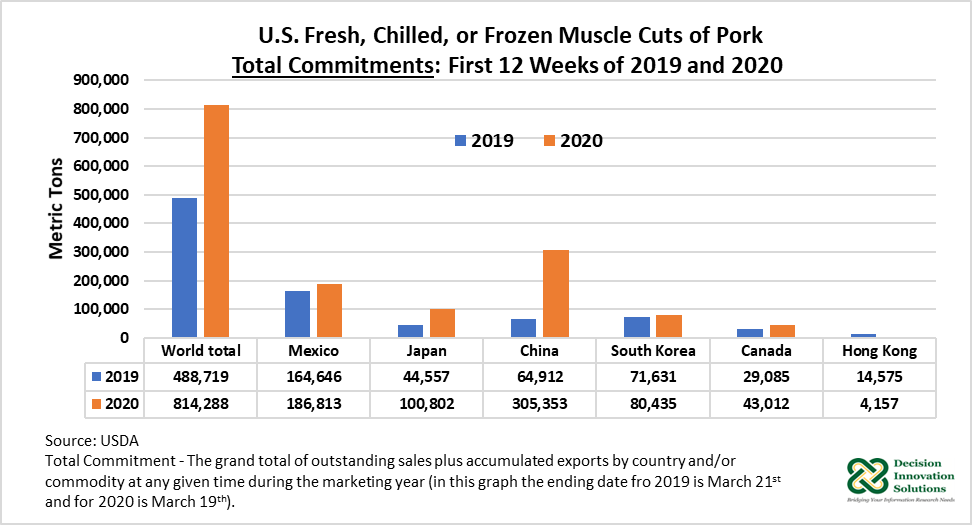

The grand total of accumulated exports plus outstanding sales by country and/or commodity at any given time during the marketing year is termed as “Total Commitments”. Total commitments in the case of U.S. fresh, chilled, or frozen cuts of pork reached a volume of 814,288 MT by the 12th week of 2020 (March 19, 2020). That volume was up 67% compared with the 12th week in 2019 (March 21, 2019). Thirty seven percent of total commitments were from China, followed by Mexico with 23% and Japan with 12%. In addition, South Korea and Canada share of total commitments were estimated at 10% and 5%, respectively.

Figure 5, U.S. Fresh, Chilled, or Frozen Muscle Cuts of Pork Total Commitments: First 12 Weeks of 2019 and 2020

2020 Pork Export Outlook

The approval of the U.S.-Mexico-Canada Agreement (USMCA), at the beginning of 2020, is expected to expand U.S. pork exports to these two important markets (Canada and Mexico). The U.S.-China “Phase One” trade agreement signed on January 15, 2020, and entered into force on February 14, 2020, expands the permissible product range for U.S. pork and pork products that are slaughtered, further processed, and certified in facilities listed in the updated USDA Food Safety and Inspection (FSIS) Export Library to China eligible plant list. With more approved facilities and more transparent eligibility for processed pork products and trimmings, exports to China are expected to grow above current levels. Furthermore, the negative impact of ASF on China’s hog/pork production is anticipated to boost China’s demand for U.S. pork in 2020. In its latest forecast (March 2020), USDA indicated 2020 U.S. pork exports would increase 22.6% to 7.750 billion pounds (carcass weight equivalent) year-over-year (6.321 billion pounds, carcass weight equivalent). At this rate, 27% of 2020 U.S. pork production (28.985 billion pounds) would be exported, which would be up from 22% in 2019.

As indicated by the U.S. Meat Export Federation (when referring to January 2019 U.S. meat exports), amidst the Coronavirus (COVID-19), several supply and demand fundamentals and market access enhancements have supported continued strong export volumes. Because of COVID19, important markets have experienced reduction in tourism and food-away-from-home consumption (restaurant dinning), but countries such as South Korea and Japan, are using e-commerce and delivery services at remarkable levels. As this pandemic continuous, new challenges for meat exports will unfold and will likely be more evident in the following months as new export data is available.

1 U.S pork muscle cut exports are a part of total U.S. pork exports and represent about 80% of total U.S. pork exports. Variety meats are the second component of U.S. pork exports. Products included in U.S. pork muscle cut exports are: 1) fresh/chilled/frozen, 2) hams/shoulders/cured, 3) cured Bacon, 4) not canned prepared/preserved, and 5) canned prepared /preserved.