U.S. net cash income (gross cash income minus cash expenses) and U.S. net farm income (total gross income minus total expenses) in the 2016 calendar year are forecast to decline year over in response to low commodity prices. The latest USDA-ERS’s Farm Income and Wealth Statistics data published on November 30, 2016, indicates that compared with the previous year, U.S. net cash income is expected to fall 14.6% to $90.1 billion. U.S. net farm income is forecast to decline 17.2% to $66.9 billion. These new projections further deteriorated from the August 30,2016 projections for these two measures. Both measures are expected to fall for a third year in a row from record highs in 2013. Net cash income includes only cash receipts and cash expenses, whereas net farm income, in addition to include net cash income, includes non-money income (the value of home consumption of farm products), the value of inventory adjustment, and implicit rent and expenses pertaining to the farm operator's dwelling that are not reflected in cash.

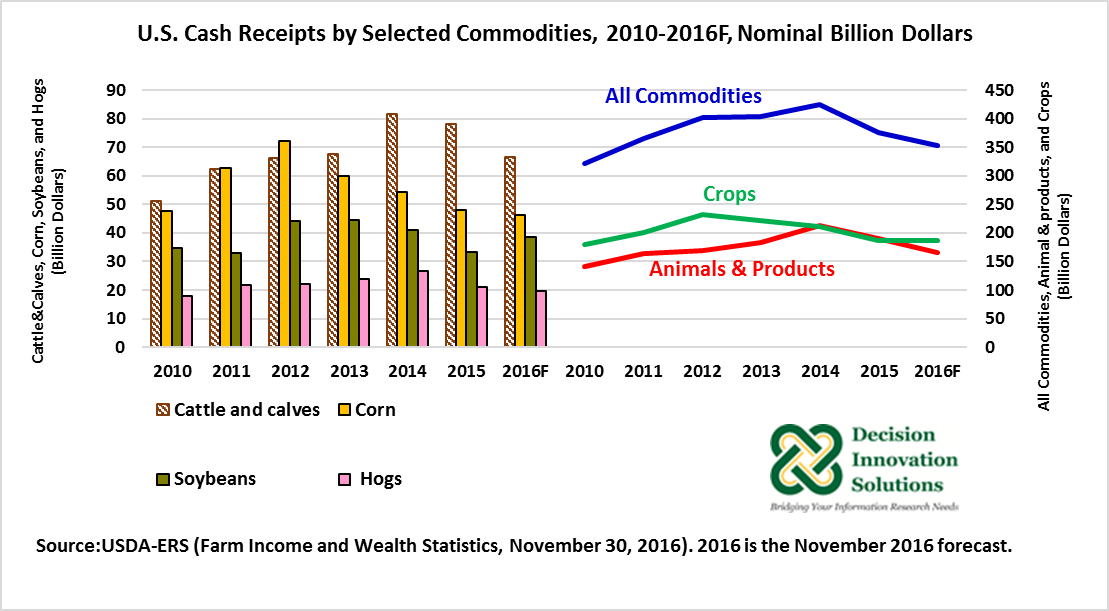

Cash receipts from all commodities are forecast to decline by $23.4 billion (6.2%) to $352.9 billion in 2016 from the estimated value for last year ($376.3 billion) (see Figure 1). Due to low commodity prices in response to large livestock supplies cash receipts for animals and products are forecast to drop 12.3% to $166.4 billion. The expected level of cash receipts for animal and products, if realized, will be the lowest since 2011. Cash receipts for cattle/calves, hogs, and broilers are expected to decline 14.8% (to $66.6 billion), 6.9% (to $19.6 billion), and 7.8% (to $26.5 billion), respectively, from the previous year.

Cash receipts for total crops are forecast to slightly increase from last year to $186.492 billion, moving up only 0.004% ($7.5 million) relative to the 2015 estimate ($186.485 billion). Corn and soybean cash receipts are forecast to represent 24.8% and 20.7%, respectively, of total cash receipts from crops ($186.5 billion). Corn cash receipts ($46.2 billion) are expected to decline 4.0%, which would represent a fourth consecutive decline from 2012 record high (see Figure 1). Cash receipts for soybeans ($38.6 billion) are projected to rise 16.3% from the estimated value for 2015), but would remain below 2014 levels. Among the few commodities projected to increase their cash receipts in 2016, soybeans show the largest increase. Overall, with oil crops cash receipts projected to increase $5.4 billion year over year.

Figure 1. U.S. Cash Receipts by Selected Commodities, 2010-2016F, Nominal Billion Dollars

Figure 1. U.S. Cash Receipts by Selected Commodities, 2010-2016F, Nominal Billion Dollars

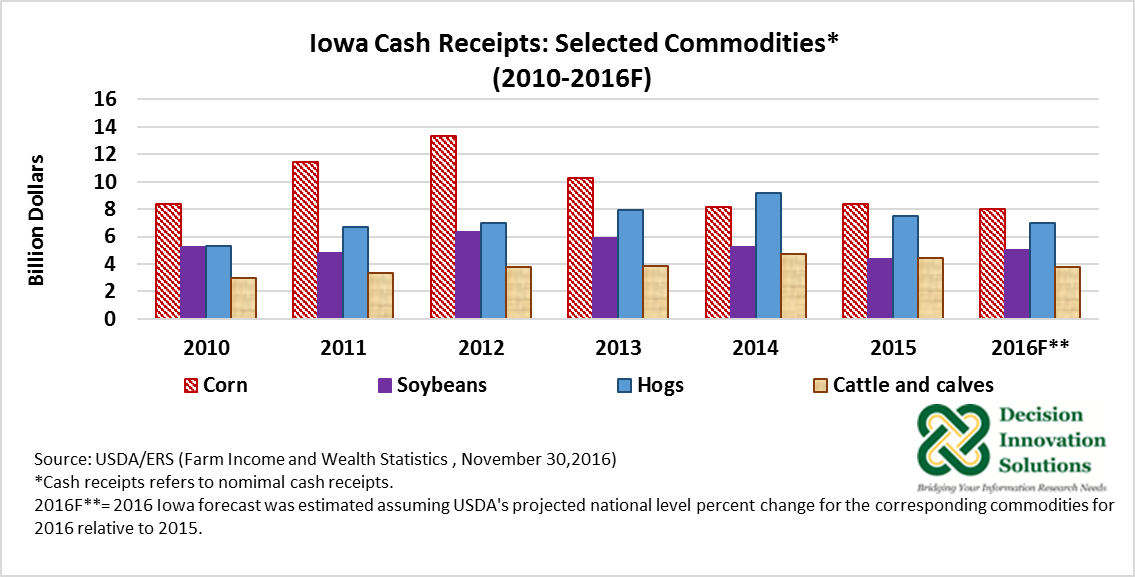

USDA/ERS cash receipt state data are available through 2015. Iowa’s cash receipts for corn, soybeans, hogs and cattle/calves for 2016 were estimated assuming the USDA's forecast national level percent reduction for the corresponding commodities for 2016 relative to 2015. Based on this assumption, the resulting estimates shown in Figure 2 indicates that 2016 Iowa’s corn cash receipts would decrease by $0.3 billion, from $8.3 billion in 2015 to $8.0 billion in 2016, whereas soybean cash receipts would increase by $0.71 billion, from $4.3 billion in 2015 to $5.0 billion in 2016. Iowa’s cash receipts for hogs would decline to $7.0 billion in 2016 compared with $7.5 billion in 2015, and cattle/calves would drop to $3.8 billion from the estimate for 2015 ($4.4 billion).

Figure 2. Iowa Cash Receipts: Selected Commodities (2010-2016F)

Figure 2. Iowa Cash Receipts: Selected Commodities (2010-2016F)

Production expenses are projected down 2.6% to $349.6 billion in 2016 compared with 2015. Expenses for inputs of farm origin (e.g., feed and livestock/poultry) are forecast to drop 6.1% to $103.5 billion, with the largest reduction in livestock and poultry expenses, from 30.4 billion in 2015 to $23.5 billion in 2016 (22.5% decline). Manufactured inputs are expected down 8.3% to $54.2 billion. More specifically, manufactured inputs such as fertilizer/lime/soil conditioner and fuel/oils are forecast down 15.3% (to $21.6 billion) and 12.2% (to $11.6 billion) from the previous year, respectively. However, pesticide is forecast to increase 3.0% to $15.1 billion relative to 2015. Electricity is also expected to increase 3.7% from $5.7 billion in 2015 to $5.9 billion in 2016.

Cash labor expenses are forecast up 5.4% to $33.3 billion relative to 2015 ($31.6 billion) as a result of higher hired labor costs, which are anticipated to increase 7.3% from $25.9 billion in 2015 to $27.8 billion in 2016. Due to expected lower real estate interest expenses in 2016, interest expenses are expected down 3.8% to $15.8 billion compared with 2015. Relative to 2015, real estate interest expenses, including operator dwellings, are forecast to drop 7.7% to 9.1 billion.

Farm equity is expected to fall 3.1% ($79.9 billion) to $2,473 billion in 2016 relative to 2015 in response to an increase in farm sector total debt and a reduction in agricultural assets compared with last year. Farm sector total debt is forecast up by 18.7 billion (5.2%) to $375.4 billion and farm sector assets are expected to decline by $61.3 billion (2.1%) to $2,849 billion. The debt-to-asset ratio and debt to equity ratio, which are farm solvency measures, are forecast to increase to 13.2% and to 15.2% in 2016 compared with 2015, respectively. Although these measurements are historically low, they have been deteriorating for the last three years.

Government farm program payments in 2016 are forecast up $2.1 billion (19.1%) to $12.9 billion year over year. This increase will be through Agricultural Risk Coverage (ARC) and Price Loss Coverage (PLC) payments. The ARC and PLC programs were established by the 2014 Farm Bill (Commodity Programs- Title I). ARC and PLC are expected to account for 46.1% ($5.940 billion) and 15.2% (1.960 billion) of total government payments to agriculture in 2016. Payments from these programs combined ($7.9 billion) are forecast to represent 11.8% of net farm income in 2016 ($66.9 billion). Conservation program payments are forecast to account for 28.6% (3.7 billion) of total government payments to agriculture, increasing 1.9% from the previous year (see Figure 3).

Figure 3. U.S. Government Total Agricultural Payments and Selected Programs

Figure 3. U.S. Government Total Agricultural Payments and Selected Programs

On October 6, 2016, USDA Iowa Farm Service Agency (FSA) announced that about 154,000 Iowa farms that had enrolled in the safety-net programs (i.e., Agriculture Risk Coverage (ARC) and Price Loss Coverage (PLC)) will receive financial assistance for the 2015 crop year. Statewide, 147,133 farms participated in ARC-County and 6,592 farms participated in PLC. According to USDA-FAS as of November 8, 2016, Iowa’s ARC/PLC payments for the 2015 crop were equal to $660.5 million, with $656.4 million for the ARC program and $ 4.1 million for PLC.

The farm income and balance sheet forecast for 2016 will be converted to estimate in the August 2017 release and will also add state-level farm income estimates and will revise previous years’ estimates.