The U.S. Energy Information Administration (EIA) published its Monthly Energy Review report on February 23rd, 2023 and its Monthly Biofuels Capacity and Feed Stocks Update Report on February 28th, 2023. In this article, we will conduct a descriptive analysis of pure biodiesel (B100) production and its feedstocks usage.

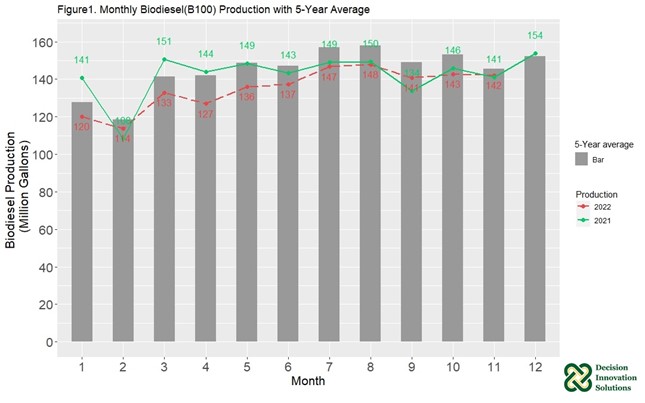

Biodiesel Production and Five-Year Average

EIA reported an average of 142 million gallons of pure biodiesel was produced in September through November 2022, which was 5 million gallons less when compared to the average of these three months in 2021, and 15 million gallons less compared to the average of the fourth quarter in 2020. Assuming the B100 production in December 2022 is 142 million gallons, total production of B100 dropped 5% in 2022, with 1,629 million gallons produced, compared to 1,709 million gallons produced in 2021. In Figure 1, the red dashed line represents the B100 production in 2022. The green solid line represents the B100 production in 2021. The gray bar represents the 5-year average (2017 to 2021) biodiesel production for each month. Biodiesel production in all 11 months in 2022 was lower than the 5-year average.

Biodiesel Feedstocks Usage Five Year Outlook

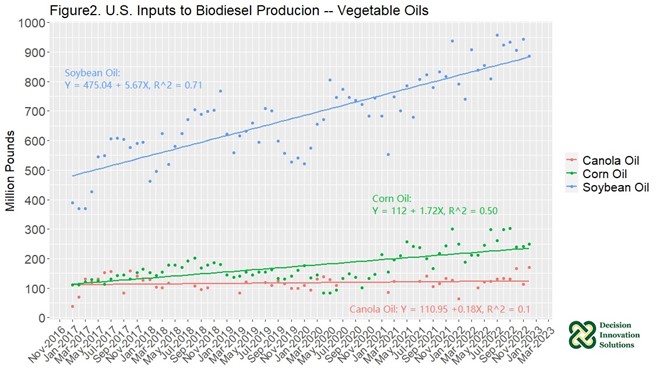

Figure 2 shows the monthly usage of vegetable oils, i.e., canola oil (represented by red color), corn oil (green color) and soybean oil (blue color), in biodiesel production from January 2017 to November 2022. Some data records for canola oil are missing because EIA withheld them to avoid disclosure of individual company data. Soybean oil remains the largest oil input for the entire study period.

In 2022, soybean oil inputs to biodiesel production were 10,494 million pounds (47.0% of total feedstock input in the year of 2022), 1,346 million pounds more than 2021 soybean oil input. Canola oil input was 1,252 million pounds to biodiesel production (5.6% of total feedstock input in 2022), 300 million pounds over 2021 canola oil input. Corn oil input was 2,994 million pounds (13.4% of total feedstock input in 2022), 357 million pounds more than 2021 corn oil input.

Application of simple linear regression models on vegetable oil inputs across time, results in significantly increasing trends for soybean oil and corn oil inputs over time, shown in blue and green colors, respectively. There is no significant trend observable for Canola oil, it is neither increasing nor decreasing. For the last five years though, soybean oil is still the top feedstock contributor for B100 production even though the percentage of soybean oil input has decreased among all oil inputs, from its highpoint in 2020 of 65.9% to 47.0% in 2022.

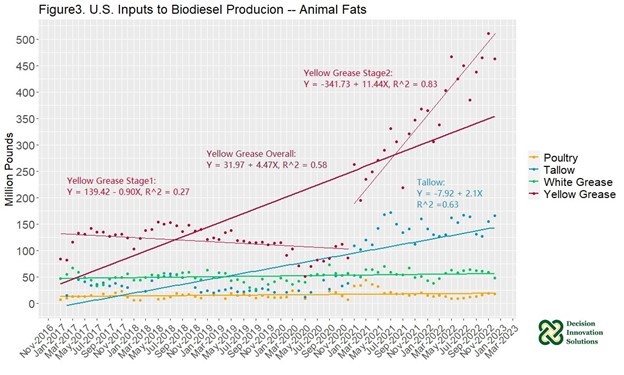

Figure 3 shows the monthly usage of animal fats and recycled feeds, i.e., poultry fat (represented by yellow color), tallow (blue color), white grease (green color, also called choice white grease) and yellow grease (red color), in biodiesel production within the same study period. Again, some data records for poultry fat and tallow are missing because EIA withheld them to avoid disclosure of individual company data.

Yellow grease, which includes recycled cooking oil, is the top animal fats and recycled feeds input to U.S. biodiesel production from 2017 January to 2022 December. Annual total yellow grease usage, in 2022, was 5,011 million pounds, 1,619 million pounds more when compared to 2021 and about 4,000 million pounds more when compared to 2020. Annual yellow grease usage increased 47.7% compared to total yellow grease inputs in 2021 and increased 375.7% more compared to total yellow grease inputs in 2020. Total 2022 tallow input, with 1,752 million pounds, increased 8.1% compared to the 2021 input, with 1,621 million pounds, and increased 437.4% more compared to tallow inputs in 2020. On the other hand, white grease annual input decreased 4.7% from 694 million pounds in 2021 to 662 million pounds in 2022. And poultry fat decreased 47.6% from 308 million pounds in 2021 to 162 million pounds in 2022.

Animal fats and recycled feeds usage captured about 34.0% of total feedstock usage in 2022. Yellow grease accounted for 22.4% of that 34%, following by tallow with 7.8%, white grease with 3.0%, poultry fat with 0.7%, and with “other” input unknown. The animal fats and recycled feedstock usage increased about 26.1% compared to 2021, with 1,570 million used.

Yellow grease and tallow inputs have shown increasing trends in biodiesel production. Yellow grease and tallow became the number two and number three fats & oils inputs for biodiesel production since 2021, respectively. Corn oil was the second largest oil input before 2021. Regression models indicate the same conclusion, yellow grease input (for both overall period and stage 2, which is from January 2021 to November 2022), and tallow input have trends which are significantly increasing over the study period shown as the red equation and blue equation respectively in Figure 3.

In conclusion, although biodiesel production has experienced a slightly decreasing trend, several of the major inputs of biodiesel production are trending upward reflecting a switching contribution among different fats and oils inputs. Yellow grease and tallow have seen a strong increasing trend, and they may become the leading fats & oils inputs for biodiesel production in the future. Other animal fat inputs, such as poultry fat and white grease have seen a decreasing trend. The input share of soybean oil is declining, though the total input of SBO in B100 production is trending up. The percentage of contribution is down 25.2% from 2020 to 2022.