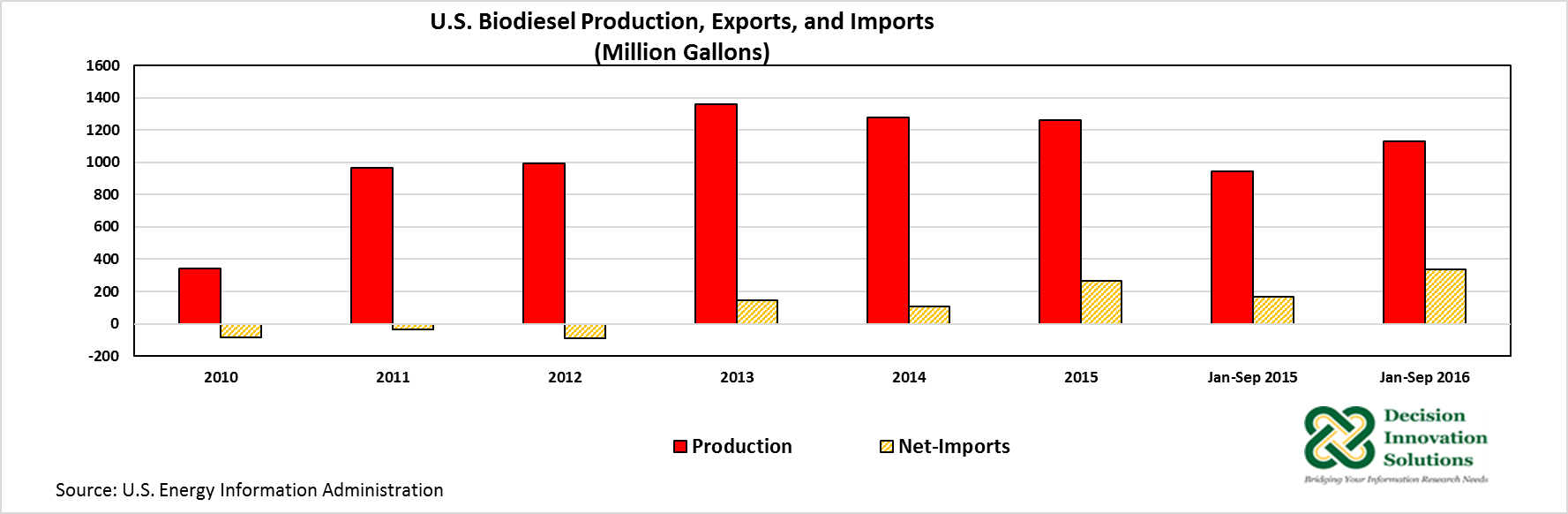

Biodiesel production in the United States in 2015 reached a volume of 1.263 billion gallons, declining 1.2% from the 2014 level (1.278 billion gallons) (see Figure 1). Production from January to September 2016 was up 19.7% to 1.128 billion gallons compared with the same period the previous year (0.943 billion gallons). Production estimates for the entire 2016 year by the U.S. Energy Information Administration, published in the January 2017 edition of the Short Term Energy Outlook report, indicated biodiesel production in 2016 averaged 1.518 billion gallons/year (99,000 barrels/day), increasing 20.1% compared with 2015. The report also indicated 2017 U.S. biodiesel production is expected to increase 5.1% to 1.594 billion gallons/year (104,000 barrels/day) relative to 2016. EIA projects 2018 biodiesel production at 1.701 billion gallons (111,000 barrels/day) up 12.1% from the 2016 estimate.

The $1/gallon biodiesel tax credit implemented in 2005 has played a role in the development of the biodiesel industry. The tax credit has had extensions and also has been allowed to expire temporarily, creating uncertainty in the industry. In December 2015, Congress retroactively extended the tax credit for two years, from January 1, 2015 through December 31, 2016.

U.S. biodiesel imports have been encouraged as the tax credit goes to the blender of the biodiesel with a traditional fuel, and not to the producer of the biodiesel. In 2015, U.S. biodiesel imports rose 83.5% to 0.353 billion gallons from 0.192 billion gallons in 2014. Although U.S. biodiesel exports increased 5.9% in 2015 relative to the previous year, the U.S. continued as a net biodiesel importer, with a net import volume of 0.265 billion gallons in 2015. Biodiesel imports during the first nine months of 2016 increased 70.6% to 0.412 billion gallons, compared with 0.242 billion gallons in the same time period in 2015. The January-September 2016 totals surpassed the 2015 import total of 0.353 billion gallons.

Figure 1. U.S. Biodiesel Production, Exports, and Imports (Million Gallons)

Figure 1. U.S. Biodiesel Production, Exports, and Imports (Million Gallons)

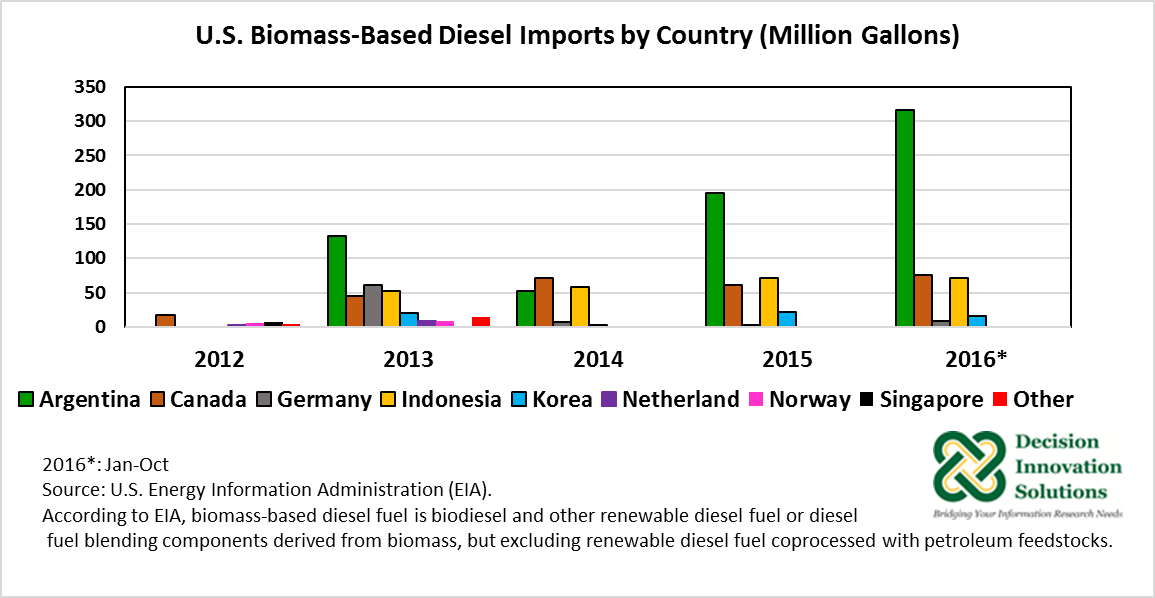

In 2013, Argentina emerged as the main supplier of imported U.S. biomass-based diesel (biodiesel and renewable diesel) (see Figure 2). At the same time, Argentina’s exports to the European Union (EU) in 2013 were negatively impacted due to anti-dumping duties imposed by the EU on that country. Argentina’s biodiesel production is forecast to increase to a record volume of 0.819 billion gallons (3.1 billion liters) in 2017, due to record domestic demand and an expansion of exports. The U.S. is expected to be the main export destination of Argentina’s biodiesel in 2016 and 2017, to meet growing mandates (USDA-FAS, 2016).

Figure 2. U.S. Biomass-Based Diesel Imports by Country (Million Gallons)

Figure 2. U.S. Biomass-Based Diesel Imports by Country (Million Gallons)

Feedstocks

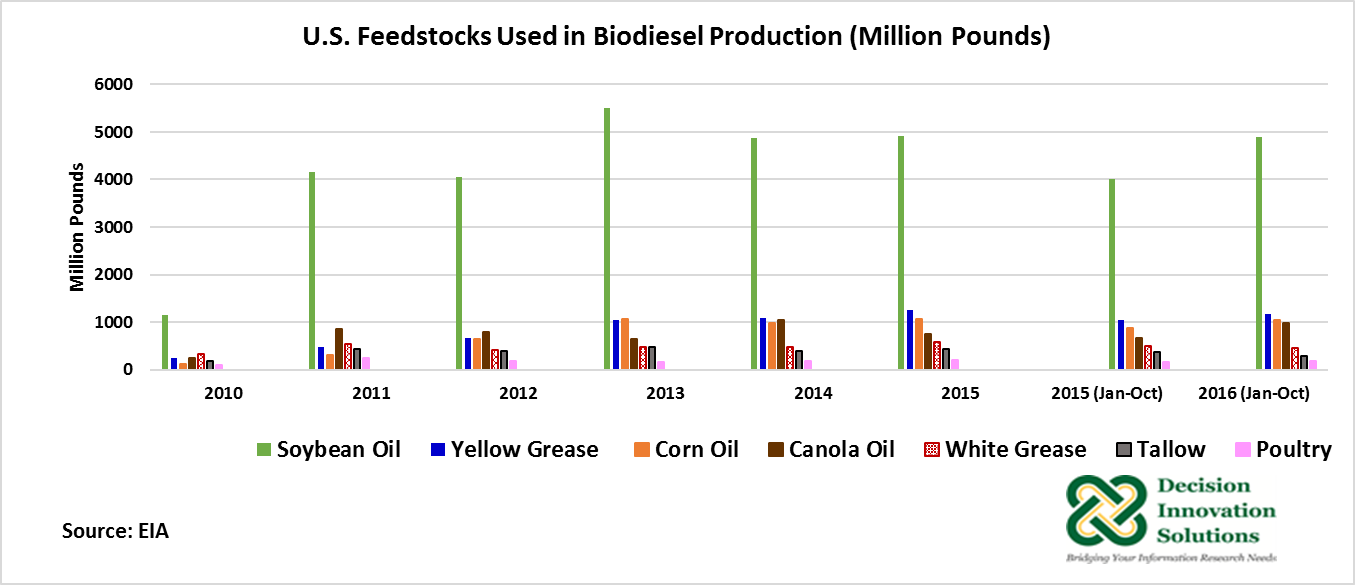

Soybean oil is the main feedstock used in U.S. production of biodiesel (see Figure 3). Based on January 2017 data from the USDA (U.S. Bioenergy Statistics), in the 2006/07 agricultural marketing year, 13.5% of U.S. soybean oil production was used to produce biodiesel, whereas in 2014/15 that share increased to 23.5% and the estimated percent for 2015/16 is 25.8%. Data from the Monthly Biodiesel Production (MBP) report published by EIA on December 30, 2016, indicated from January to October 2016, 4.889 billion pounds of soybean oil and 1.037 billion pounds of corn oil were used in biodiesel production. The amount of soybean oil and corn oil used to produce biodiesel increased 22% and 19%, respectively, compared with the same period in 2015, in response to the larger production of biodiesel in 2016. Some other feedstocks used in biodiesel production during the first ten months of 2016 were yellow grease (1.160 billion pounds), canola oil (0.977 billion pounds), and white grease (0.455 billion pounds). Yellow grease and canola oil use increased by 11% and 49% relative to the same period in 2015, whereas white grease declined 6%. The variety of feedstocks that can be used in the production of biodiesel gives some flexibility to the industry. Overall, in terms of percentage change, since 2010 corn oil usage in the production of biodiesel has increased the most (see Figure 3) aided by the U.S. ethanol industry having widely implemented corn oil extraction technology. Corn oil use increased from 0.112 billion pounds in 2010 to 1.057 billion pounds in 2015, representing an 843% increase.

Figure 3. U.S. Feedstocks Used in Biodiesel Production

Figure 3. U.S. Feedstocks Used in Biodiesel Production

In its January 2017 edition of the World Agricultural Supply and Demand Estimates (WASDE) report, the USDA projected consumption of 6.200 billion pounds of soybean oil to produce biodiesel in the 2016/17 marketing year, up 9.3% compared with the previous marketing year (5.670 billion pounds). If realized, 27.7% of the U.S. soybean oil production in 2016/17 will be used in biodiesel production during the current marketing year.

The Renewable Fuel Standard (RFS) program

On November 23, 2016, the Environmental Protection Agency (EPA) released the annual applicable volume requirements for cellulosic biofuel, advanced biofuel, and total renewable fuel for 2017, and for biomass-based diesel for 2018. The 2017 biomass-based diesel volume requirement was established in the final rule for “Renewable Fuel Standard program for 2014, 2015, and 2016 and Biomass-Based Diesel Volume for 2017” (Federal Register, 2015). Increasing applicable volumes for biomass-based diesel have been seen since 2013, and have been above the minimum requirement of at least one billion gallons for each year after 2012. For 2013, 2014, and 2015, EPA established biomass-based diesel volumes of 1.28, 1.63, and 1.73 billion gallons, respectively. For 2016 and 2017 those volumes increased to 1.9 and 2.0 billion gallons. The biomass-based mandate for 2018 is up 100 million gallons to 2.1 billion gallons.

Supported by the Renewable Fuel Standard increased mandates and the biodiesel tax credit of $1/gallon, biodiesel production grew during 2016. The EIA annual production estimate for 2016 of 1.5 billion gallons indicates a record-high volume that is expected to surpass 2013 production.