According to the California Air Resources Board, the Low Carbon Fuel Standard (LCFS) is formulated to lower the carbon intensity (CI) of California's transportation fuel pool and to offer a growing selection of low-carbon and renewable alternatives. CI is measured in terms of grams of carbon dioxide (CO2) equivalent per megajoule of energy (gCO2e per MJ). The program has set a declining annual target in the CI of California’s transportation fuel pool. The 2020 target is a 7.5% reduction relative to the 2010 baseline. By 2030, the LCFS intends to achieve a reduction of 20% compared with the 2010 baseline.

To comply with the LCFS program each year, petroleum importers, refiners, and wholesalers can either produce their own low carbon fuel products or buy LCFS credits from those who produce and sell lower carbon alternatives. Each LCFS credit represents one metric ton (MT) of carbon dioxide equivalent (CO2e) in greenhouse gas (GHG) reduction. Credits can be sold, banked, or used to help meet a compliance obligation.

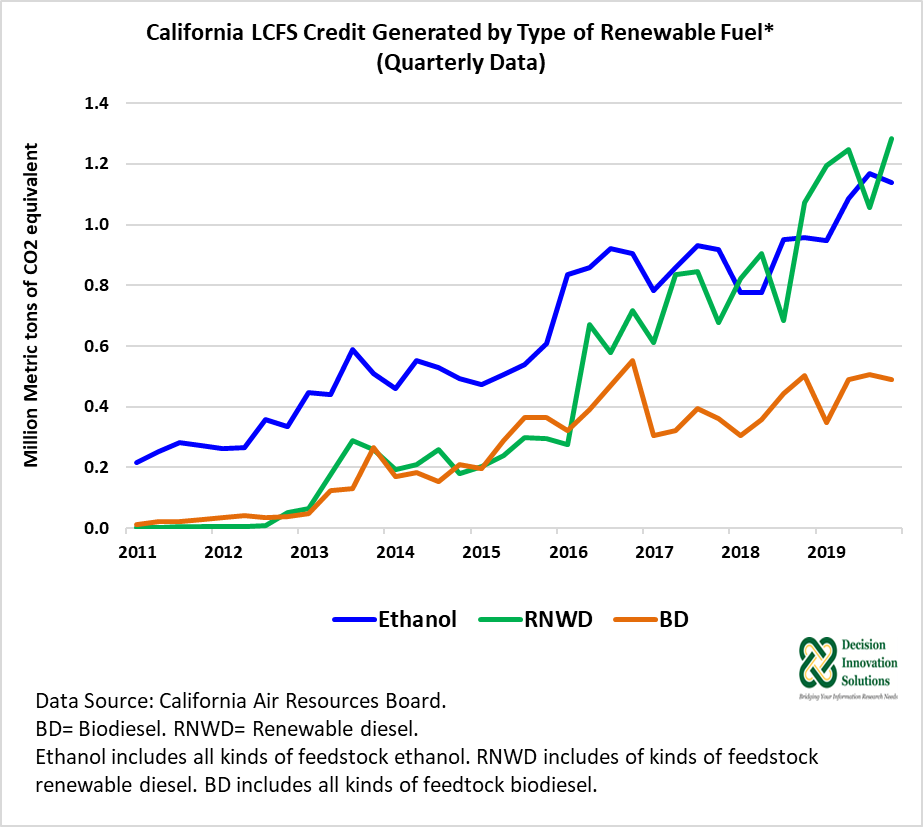

Credits supplied by ethanol increased from 1.023 million in 2011 to 4.342 in 2019. From 2011 to 2017, ethanol was the main credit generator for the LCFS program, but starting in 2018, renewable diesel surpassed the credit generated by ethanol fuel (Figure 1). Renewable diesel is chemically identical with diesel but is produced from non-petroleum renewable resources. Renewable diesel meets the American Society for Testing and Materials (ASTM) ASTM D975 specification for petroleum diesel. Also, renewable diesel is a drop-in-fuel so it can be used in any diesel engine without blending (there is no requirement for renewable diesel to blend with petroleum diesel for its use), therefore, renewable diesel can be used in existing infrastructure and engines.

Figure 1. California LCFS Credit Generated by Type of Renewable Fuel (Quarterly Data)

Since 2016, biodiesel has consistently been the third largest supplier of credits to the LCFS program (see Figure 1). Biodiesel is a mono-alkyl esters of long chain fatty acids with different physical properties from renewable diesel; hence it has a different fuel specification (ASTM D6751). Biodiesel is approved for blending with petroleum diesel, usually at a 5% to 20% ratio. Renewable diesel and biodiesel use the same feedstocks (fats, oils, and greases) but have different processing methods.

In 2019, renewable diesel supplied 4.781 million credits or 438,759 more credits than those supplied by ethanol (4.342 million) to the LCFS. The same year, biodiesel generated 1.832 million credits to that program. In 2019, the total number of credits generated by ethanol, renewable diesel, and biodiesel combined were equivalent 10.954 million MT of CO2e in GHG reduction.

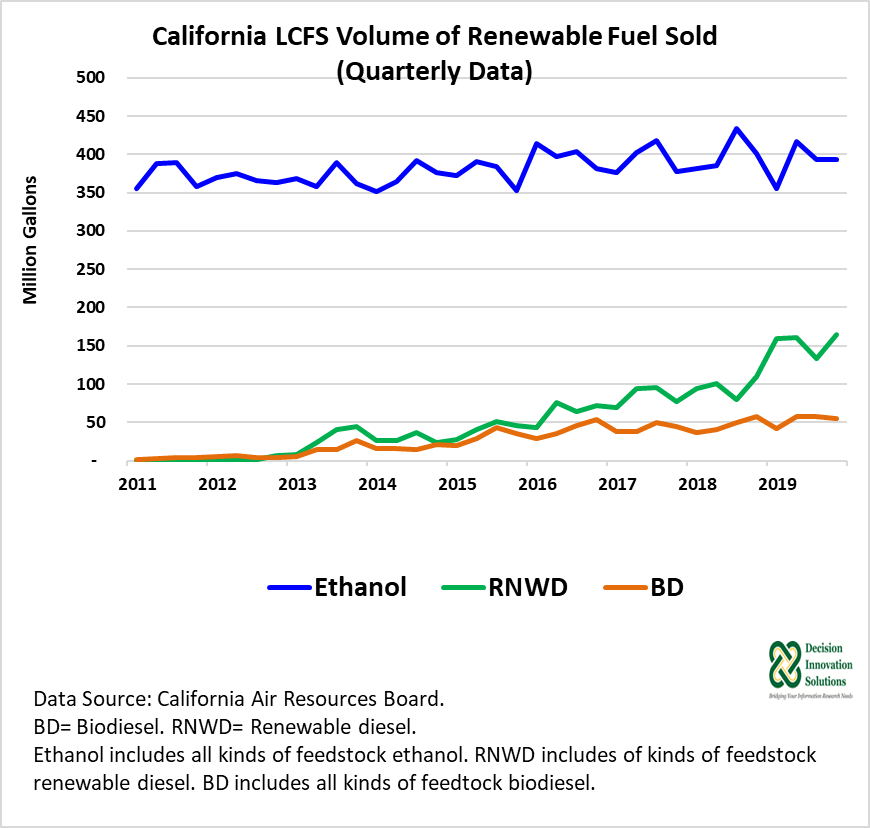

In terms of biofuel volume, from 2011 to 2019 ethanol volume supplied to the LCFS has been consistently higher than that of renewable diesel and biodiesel (see Figure 2). The number of credits generated from ethanol in 2019 was based on 1.557 billion gallons, in contrast with 617.890 million gallons of renewable diesel, and 211.645 million of biodiesel.

Figure 2. California LCFS Volume of Renewable Fuel Sold (Quarterly Data)

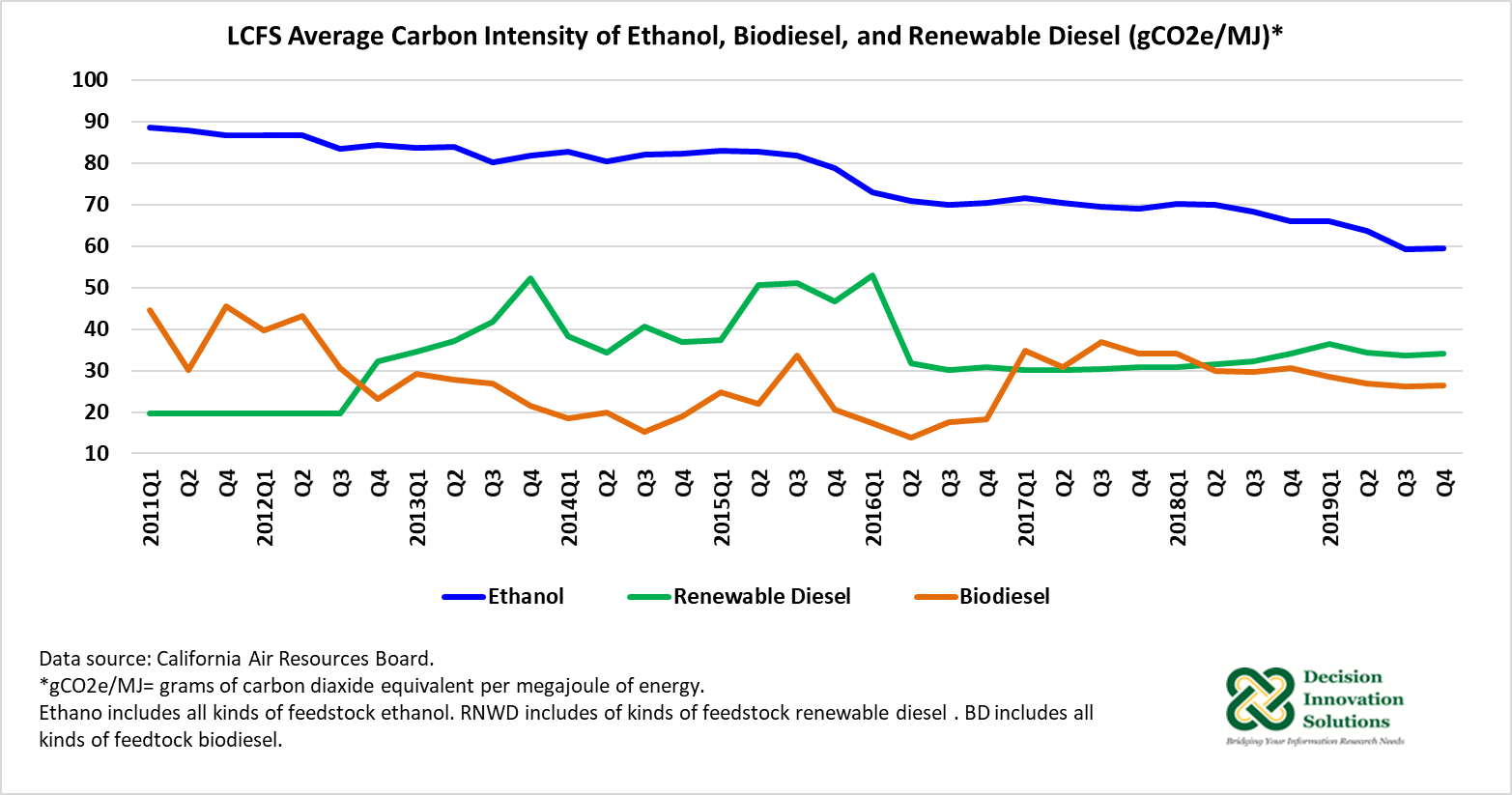

In 2019, for each gallon of renewable diesel used, about 2.5 gallons of ethanol were used, yet renewable diesel generated more credits than ethanol. Credits and volume of fuels are not directly proportional because the use of some fuels results in higher GHG reduction than others due to their lower carbon intensity scores. In those cases, more credits are assigned per gallon used. From 2018 to 2019, the CI of ethanol averaged 65.4 gCO2e/MJ, which was up 32 gCO2e/MJ from the average CI score for renewable diesel (33.4 gCO2e/MJ) during the same period (see Figure 3).

Figure 3. LCFS Average Carbon Intensity of Ethanol, Biodiesel, and Renewable Diesel (gCO2e/MJ)

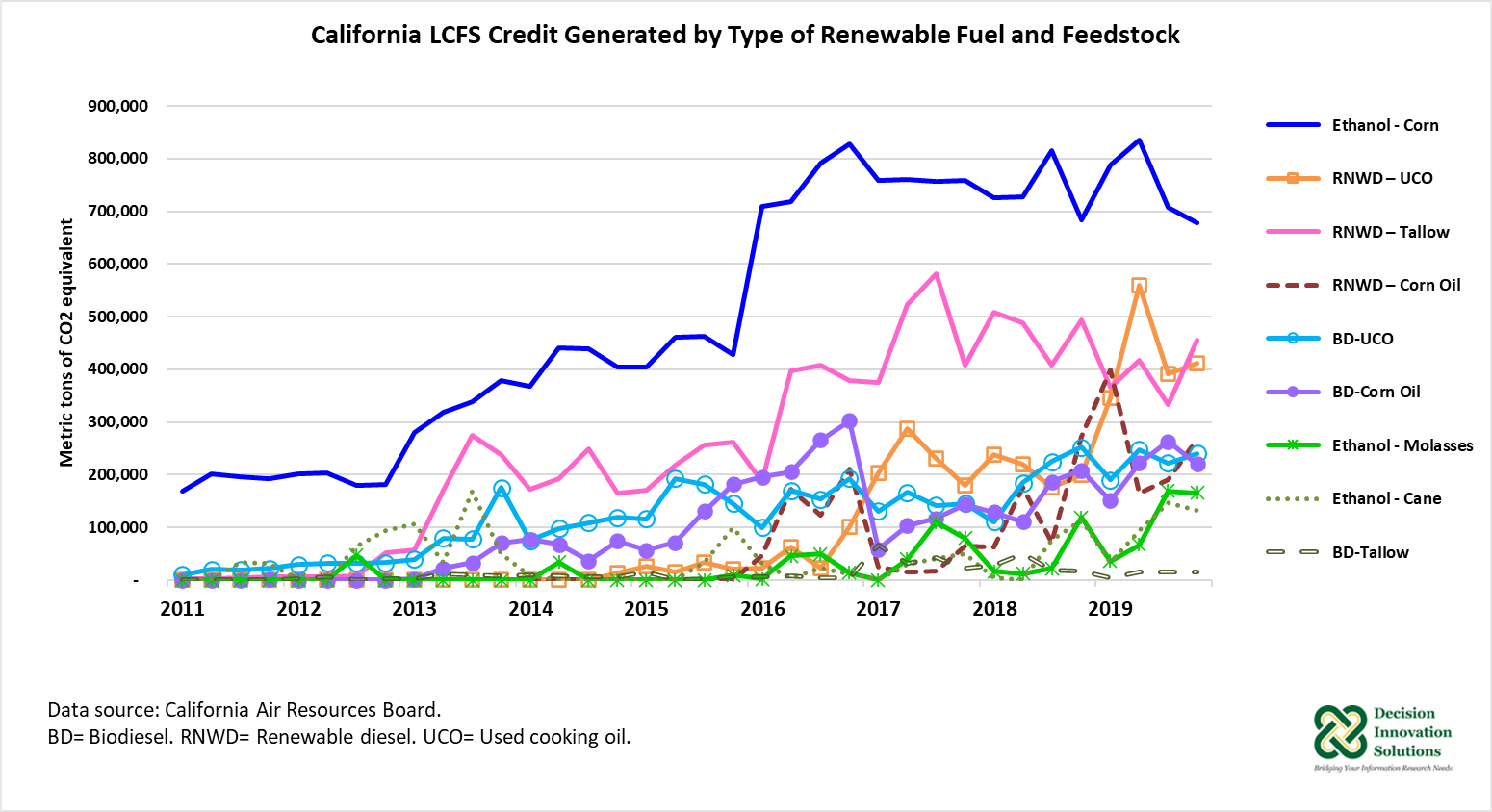

When looking at individual biofuels and the kind of feedstock used to produce them, corn ethanol continues as the top biofuel credit supplier to the LCFS program (see Figure 4). In 2019 corn ethanol supplied 3.010 million credits equivalent to 1.229 billion gallons. The second and third largest generators of credit were renewable diesel produced from used cooking oil (UCO) with 1.709 million credits (191.390 million gallons), followed by renewable diesel produced from tallow with 1.573 million credits (207.962 million gallons). UCO renewable diesel started to generate credits for the LCFS in 2014 and in 2019 it surpassed the credits generated by tallow renewable diesel.

Figure 4. California LCFS Credit Generated by Type of Renewable Fuel and Feedstock

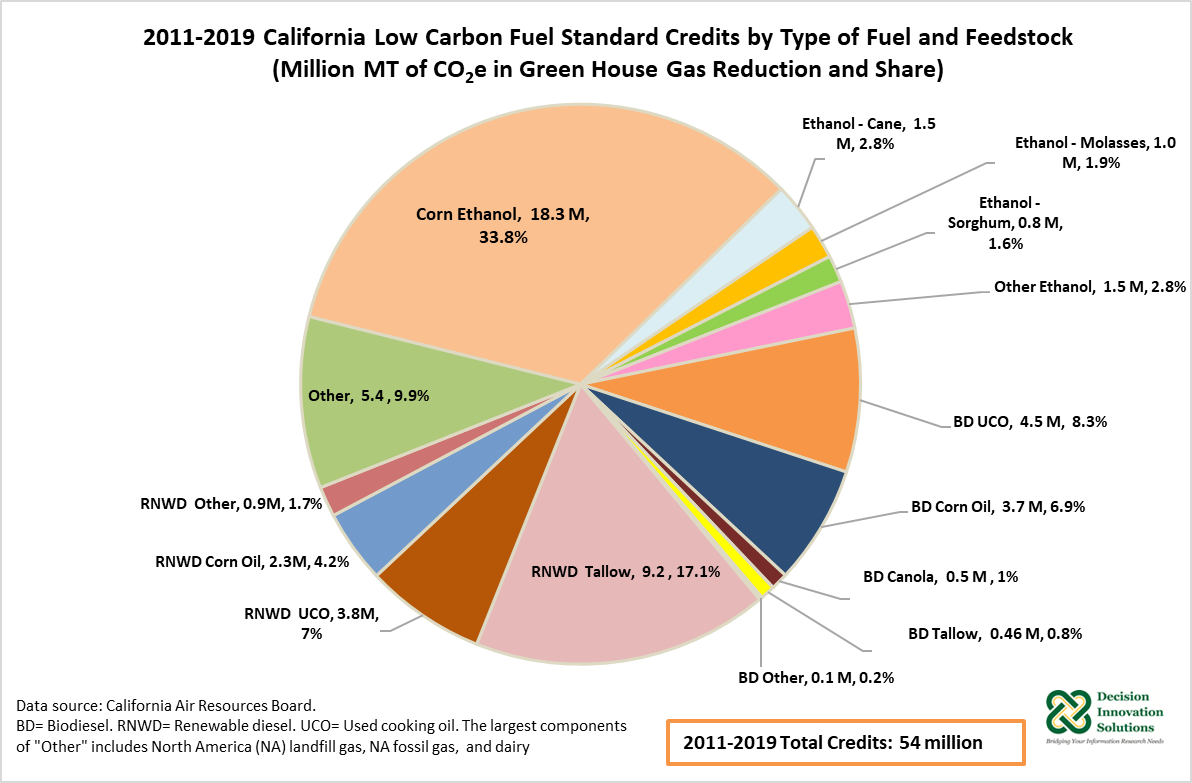

About 54 million credits have been generated by all fuels in the LCFS program during the 2011 to 2019 period. Seventy three percent of those credits were generated by five renewable fuels: corn ethanol with a 33.8% of total credits (18.3 million credits, 11.770 billion gallons), renewable diesel from tallow with 17.1% of total credits (9.2 million credits, 1.118 billion gallons), UCO biodiesel with 8.3% (4.5 million credits, 431.302 million gallons), UCO renewable diesel with 7.0% (3.8 million credits, 393.310 million gallons), and corn oil biodiesel with 6.9% (3.7 million credits, 391.090 million gallons).

Figure 5. 2011-2019 California Low Carbon Fuel Standard Credits by Type of Fuel and Feedstock (Million MT of CO2e in Green House Gas Reduction and Share)

Overall, recent data shows that renewable diesel is generating more credits than ethanol in the California’s LCFS. The LCFS incentivizes the use of lower carbon intensity products such as renewable diesel, which is also a drop-in-fuel that can be used directly without blending it with petroleum diesel.

Both biodiesel and renewable diesel are produced using the same kind of feedstocks (fats, oils and greases) and for those plants relying heavily on animal waste and residues as feedstock, if COVID-19 limits animal processing plant production due to temporary closing, feedstock availability can become an issue for the production of biodiesel and renewable diesel. In addition, as reported, some refiners are exploring opportunities to start adding renewable diesel capacity, which is seen as a cost cutting move that can help them satisfy requirements to blend their own fuel pool with biofuels or buy credits from those that do so. If this trend continues, there could be some feedstock constraints in the industry.