Biomass-based diesel includes both biodiesel and renewable diesel. Biodiesel and renewable diesel are produced using the same kind of feedstocks (fats, oils, and greases) but have different processing methods. Biodiesel is a mono-alkyl esters of long chain fatty acids approved for blending with petroleum diesel, usually at a 5% (B5) to 20% (B20) ratio. Renewable diesel on the other hand, is chemically identical with diesel but is produced from non-petroleum renewable resources. Renewable diesel is a drop-in-fuel so it can be used in existing infrastructure and diesel engines and there is no requirement for renewable diesel to blend with petroleum diesel for its use.

Biodiesel as well as renewable diesel benefit from incentives for renewable fuel production supported by the Renewable Fuel Standard, California Low Carbon Fuel Standard (CA-LCFS), and Oregon’s Clean Fuels Program. In addition, the tax incentive of $1/gallon of biodiesel or renewable diesel mixed with petroleum diesel is still running through the 2022 year.

As of January 1, 2022, there were 11 plants for renewable diesel fuel (and other biofuels) in the U.S. with a total production capacity of 1.75 billion gallons/year[1]. Some of these renewable diesel plants were converted from petroleum refineries. Louisiana holds 62% (1.01 billion gallons) of the existing renewable diesel production capacity, but California has the most (for a single state) renewable diesel plants (4 plants). For biodiesel, the number of biorefineries on January 1, 2022, was equal to 72, with an annual capacity of 2.26 billion gallons/year, with Iowa holding over one fifth (21%, 470 million gallons/year) of this production capacity distributed across 11 plants.

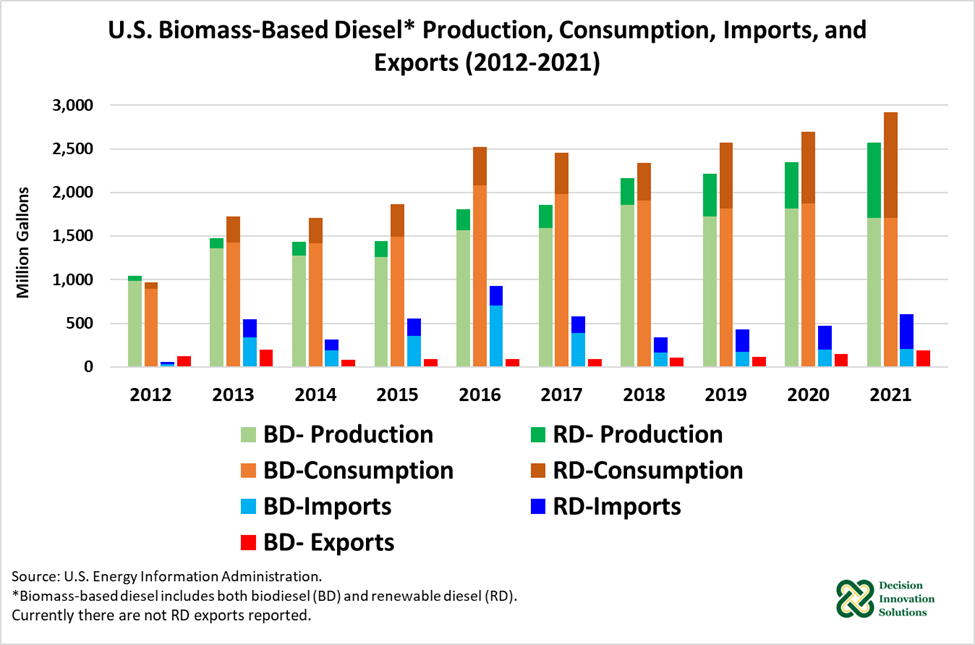

U.S. biodiesel production has fluctuated over the years, but overall, production increased from 991 million gallons in 2012 to 1.86 billion gallons in 2018. In 2021, U.S. biodiesel production was down 8% to 1.709 billion gallons from 2018. Although biodiesel is the largest component of U.S. biomass-based diesel production, renewable diesel production has consistently increased throughout the years. U.S. renewable diesel production expanded from 52 million gallons in 2012 to 861 million gallons in 2021. The share of renewable diesel production in the biomass-based diesel production increased from 5% in 2012 to 34% in 2021 (see Figure 1). Note that up to some extent, because both biodiesel and renewable diesel compete for the same feedstock, increase in the production of one of them comes with the reduction of the other.

The U.S. is a net importer of biomass-based diesel. Imports of biodiesel peaked in 2016 at 709 million gallons, which declined to 394 million gallons the following year. The U.S. imported 210 million gallons of biodiesel in 2021, with Canada supplying 61% of those imports. U.S. imports of renewable diesel topped 392 million gallons in 2021, with Singapore shipping 99.8% of this volume.

[1] According to EIA, renewable diesel fuel and other biofuels production capacity is intended to measure estimated gallons of renewable diesel fuel, renewable heating oil, renewable jet fuel, renewable naphtha and gasoline, and other biofuels (excluding fuel ethanol and biodiesel) and bio-intermediates that a plant is capable of producing over a period of one year (365 consecutive days) starting on the first day of each report month.

U.S. exports of biodiesel reached 196 million gallons in 2013, but remained below 100 million gallons between 2014 and 2017. Exports consistently increased afterward, and by 2021 the U.S. exported 187 million gallons of biodiesel.

Figure 1. U.S. Biomass-Based Diesel Production, Consumption, Imports, and Exports (2012-2021)

U.S. consumption of biodiesel and renewable diesel followed the production trend of these two types of biofuels. In 2012, renewable diesel consumption was estimated at 74 million gallons, which accounted for 8% of U.S. total biomass-based diesel consumption (973 million gallons). Renewable diesel consumption increased to 1.21 billion gallons, which made up 41% of U.S. total biomass-based diesel consumption (2.92 billion gallons) in 2021 (see Figure 1), with California market consuming a large proportion of this type of biomass-based fuel (see Table 1). In 2021, U.S. biodiesel consumption was estimated at 1.710 billion gallons in 2021, down 18% from 2016 (2.085 billion gallons).

California Market for Biomass-based Diesel

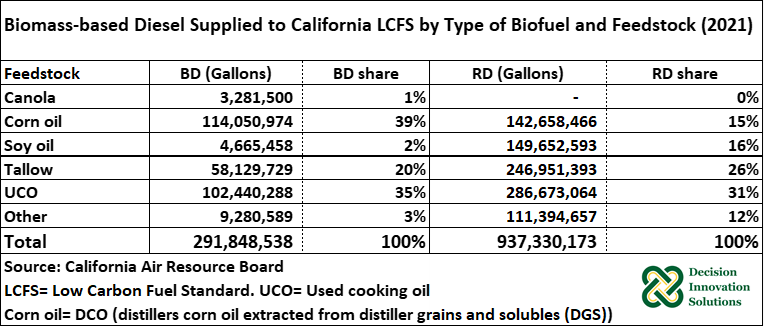

As Table 1 shows, and based on data from CA-LCFS program, California consumed 1.23 billion gallons of biomass-based diesel, which included 937.33 million gallons (76%) of renewable diesel and 291.85 million gallons (24%) of biodiesel in 2021. The feedstocks used to produce California’s low carbon intensity (CI) biomass-based diesel fuels comprise industrial by-products including used cooking oil (UCO), tallow, corn oil (i.e., distillers corn oil (DCO), which is extracted from distiller grains and solubles (DGS) as a co-product of corn ethanol production), soybean oil, and other oils (oils from fish processing). CA-LCFS favors biofuels with low CI, and renewable diesel is largely consumed in that market because, as mentioned before, this is a drop-in-fuel, chemically the same as petroleum diesel, which can be used in existing infrastructure and engines with no requirement to be blended with petroleum diesel. In contrasts, biodiesel must be mixed with petroleum diesel at a 5% to 20% ratio.

The largest share of total renewable diesel consumed in the California market was renewable diesel UCO-based with 286.7 million gallons (31%), followed by renewable diesel tallow-based (247 million gallons, 26%), renewable diesel soybean oil-based (149.6 million gallons, 16%), and renewable diesel corn oil-based (142.7 million gallons, 15%). In the case on biodiesel, almost 40% (114.1 million gallons, 39%) of total biodiesel consumed in California was biodiesel corn oil (DCO)-based, followed by biodiesel UCO-based with 102.4 million gallons (35%). The third most consumed biodiesel in California was tallow-based biodiesel at 58.13 million gallons (20%).

Table 1. Biomass-based Diesel Supplied to California LCFS by Type of Biofuel and Feedstock (2021)

Renewable Diesel Outlook

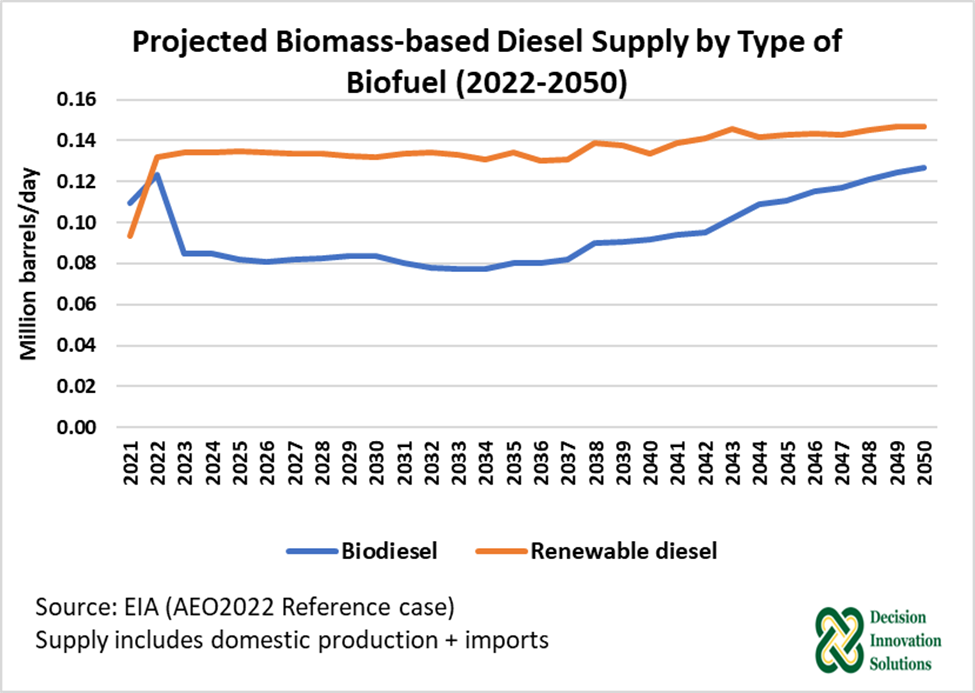

According to the Energy Information Administration (EIA)’s long term projections (AEO2022, Reference case), renewable diesel supply, which includes domestic production and imports, would increase from 94,000 barrels/day in 2021 to 147,000 barrels/day in 2050, which would surpass biodiesel supply during the entire projected period (see Figure 2). On average, the domestic production of renewable diesel would make up 72% of the supply during the projected period and the remaining 28% would be supported by imports. Biodiesel supply would decline from 123,000 barres/day in 2022 to 77,000 barrels/day in 2033 and 2034. Afterward, biodiesel supply would gradually increase to 127,000 barrels/day by 2050 (Figure 2). As indicated by EIA, based on the Reference case, renewable diesel supply expansion reflects the flexibility of this biofuel. Moreover, projected renewable diesel production expansion would depend on increased state and federal production targets for this biofuel. Other assumptions include tax credits that support this industry and expansion of production capacity primarily by converting existing petroleum refineries into renewable diesel plants. Because renewable diesel and biodiesel compete for the same feedstock, renewable diesel production expansion would imply a reduction in biodiesel production.

Figure 2. Projected Biomass-based Diesel Supply by Type of Biofuel (2022-2050)