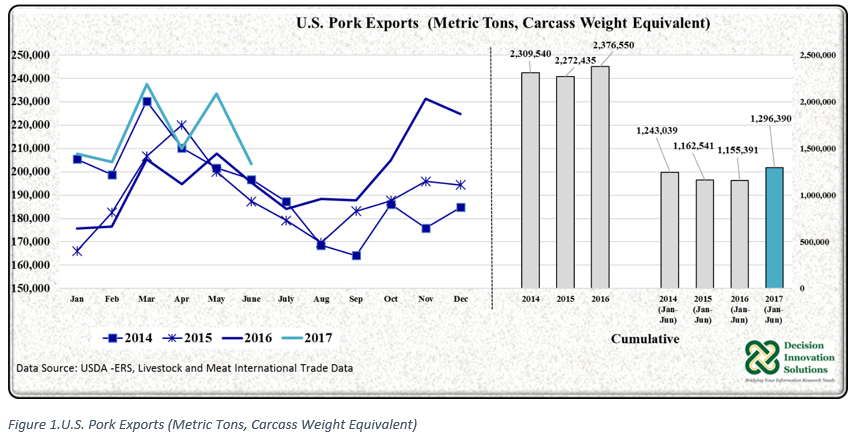

Trade data from USDA-ERS indicates the total volume of U.S. pork exports during the first six months of 2017 equaled 1.296 million metric tons (MT) carcass weight equivalent (CWE). Exports were up 12.2 percent compared with the same period in 2016 (see Figure 1). Despite this volume, exports during June 2017 declined 12.8 percent to 203,455 MT CWE from the record volume exported the previous month. Overall, U.S. pork export volumes during the first six months of 2017 (except April) have been above their corresponding volumes during 2016 (see Figure 1).

USDA data indicates that from January to June 2017 the United States exported 22.8 percent of its pork production compared with 20.9 percent during the same period last year. U.S. total pork production rose 2.9 percent from 5.531 million MT CWE during the first half of 2016 to 5.691 million MT CWE in 2017 (January to June).

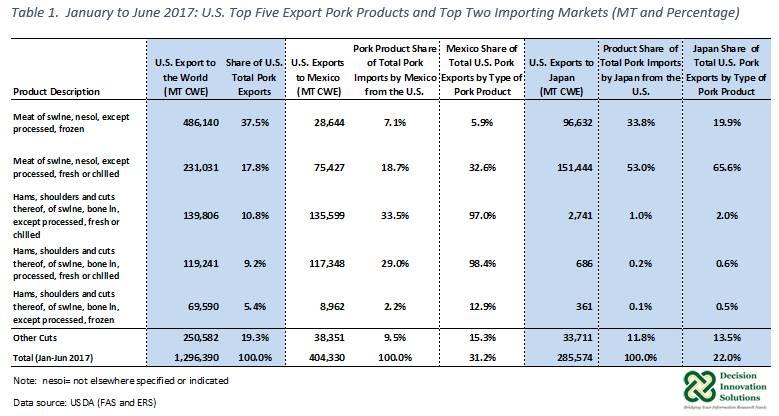

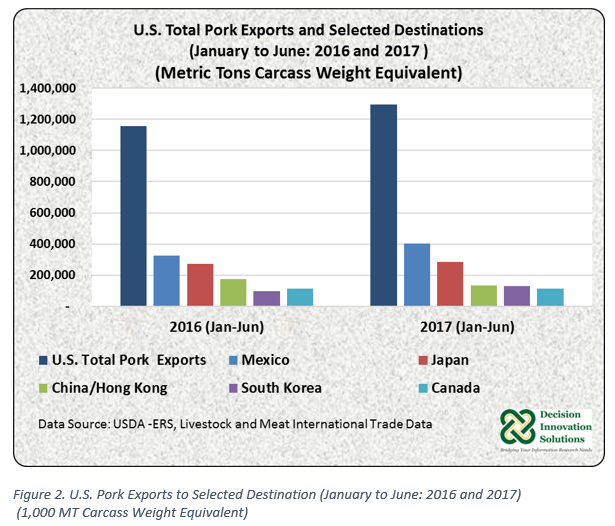

U.S. exports of frozen pork (except processed) represented 37.5 percent (486,140 MT CWE) of total U.S. exports (see Table 1). Exports of fresh/chilled pork (except processed) represented 17.8 percent (231,031 MT CWE) of total U.S. pork exports during the first two quarters of 2017. In addition, 259,047 MT CWE of fresh/chilled hams/pork shoulders bone in (both processed and excluding processed) were exported from January to June 2017, with a share of 20 percent all exports during this period.

U.S. Pork Exports to Mexico

As Figure 2 indicates, exports to Mexico, the largest volume market for U.S. pork, increased 24.7 percent to 404,330 MT CWE during the first six months of 2017 compared to the same period last year. The share of U.S. pork exports to Mexico represented 31.2% of total U.S pork exports from January to June 2017. Competitive U.S. pork prices are boosting Mexico’s imports.

U.S. exports of fresh/chilled hams/shoulders and cuts bone in, processed, are almost exclusively shipped to Mexico. This year (January to June 2017), 98.4 percent (117,348 MT CWE) of all U.S. exports of fresh/chilled hams/shoulders and cuts bone in (processed) were exported to that country. The same applies to U.S. exports of fresh/chilled hams/shoulders and cuts bone in, excluding processed, with 97.0 percent (135,599 MT CWE) of total volume of U.S. exports of this product (139,806 MT CWE) sent to Mexico (see Table 1). These U.S. pork products are also the main pork commodities imported by Mexico from the United States, with a combined share of 62.6 percent of Mexico’s total pork imports during January to June 2017. Also, 18.7 percent (75,427 MT CWE) and 7.1 percent (28,644 MT CWE) of Mexico’s total pork imports from the United States during the first six months of 2017 consisted of fresh/chilled pork (excluding processed) and frozen pork (excluding processed), respectively.

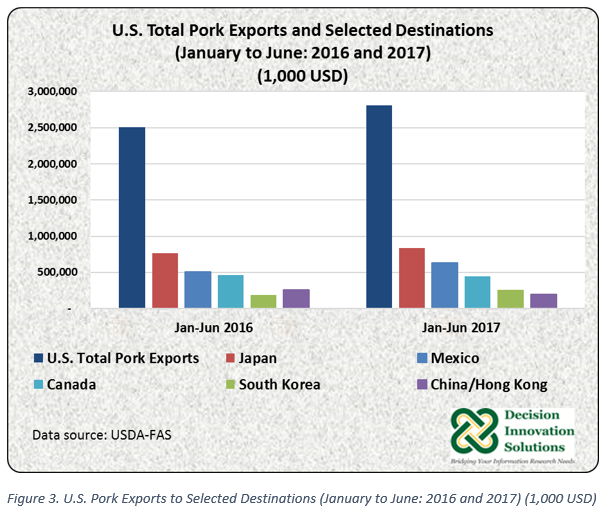

Given the large volume of shipments, Mexico was the second largest value market for U.S. pork exports with a share of 22.6 percent ($633.9 million) of the total value of U.S. pork exports ($2.808 billion) during the first half of the 2017 calendar year (see Figure 3).

According to USDA-FAS April 2017 projections, Mexico pork consumption is forecast to reach a record volume of 2.360 million MT CWE in 2017. Forty to fifty percent of the pork consumed in Mexico is imported, which is mainly from the United States. Mexico’s 2017 pork imports (from all sources) are forecast at 1.1 million MT CWE, increasing 12 and 8 percent from 2015 and 2016, respectively. Large U.S. pork production and lower prices, particularly when compared with prices in 2014 and 2015, are boosting U.S. pork exports to Mexico this year.

U.S. Pork Exports to Japan

Although U.S. pork exports to Japan in June 2017 were the lowest of the year at 42,902 MT CWE, the total volume of exports from January to June of the current calendar year was up 4.7% to 285,574 MT CWE year over year (see Figure 2). The volume of exports shipped to that country during the first two quarters 2017 represented 22 percent of total volume of U.S. pork exports during that period (see Table 1).

Japan is the second largest volume market and the leading value market for U.S. pork exports (see Figures 2 and 3). U.S. pork shipments to Japan during the first two quarters of the current calendar year were valued at $836.238 million, representing 29.8 percent of the total value of U.S. pork exports ($2.808 billion) (see Figure 3).

The United States exported 151,444 MT CWE of fresh/chilled pork (excluding processed) and 96,632 MT of frozen pork (except processed), representing 53.0 percent and 33.8 percent, respectively, of Japan’s total pork imports the from United States during January to June 2017 (see Table 1). These are higher priced cuts compared with hams, which comprise most of Mexico’s pork imports from the United States.

A semi-annual USDA report (Japan Livestock and Products) published in February 2017, indicates Japan’s total pork imports (from all sources) are forecast to decline about 1 percent to 1.350 million MT in 2017 year over year. Japanese processors are trying to draw down accumulated stocks of frozen pork imported mainly from the European Union (EU). So far (January to June 2017) U.S. pork exports to Japan have been ahead of last’s year as the United States is Japan’s primary supplier of fresh pork, which according to USDA, is marketed mainly through retail channels. Frozen pork cuts (mainly boneless bellies and shoulders), on the other hand, are used as inputs for processed pork products. Japan’s 2017 pork consumption is forecast at 2.624 million MT with imports from all sources supplying about 51 percent (1.350 million MT).

U.S. Pork Exports to Other Markets

Canada

Canada was the fifth largest volume market for U.S. pork. Exports from January to June 2017 were estimated at 114,519 MT CWE, representing 8.8 percent of U.S. total pork exports during this period. In terms of value, Canada was the third largest destination for U.S. pork during the first six months of 2017. U.S. pork exports to Canada during this period were valued at $447,623 million. This value contributed to 15.9 percent of the total value of U.S. pork exports. Almost 40 percent of Canada’s demand for U.S. pork (January to June 2017) consisted of processed fresh/chilled pork. In addition, 25% of pork imports from the United States consisted of prepared/preserved pork (including mixtures). These cuts have higher value compared with fresh/chilled hams.

The USDA reported in March 2017 that conditions in the Canadian prairies are favorable to an expansion in hog production. Nonetheless, a substantial growth is not expected until after 2017 because of the slow nature of investment expansions, the relative lower Canadian hog prices compared with prices received during 2014 to 2016, and higher U.S. pork production this year. Canada’s pork production in 2017 is forecast at 1.950 million MT CWE with most going to foreign markets. Canada’s domestic pork consumption and imports are expected to reach a volume of 855,000 MT CWE and 215,000 MT CWE, respectively.

South Korea

U.S pork shipments to South Korea increased 33.2% to 131,304 MT CWE during the first six months of 2017 relative to the same period the previous year (98,595 MT CWE) (see Figure 2). U.S. pork volume exported to South Korea so far in 2017 is the second largest after the record high achieved from January to June 2015 (145,762 MT CWE). The volume of U.S. pork exports to South Korea made up 10 percent of U.S. total volume exported from January to June 2017. The value of these exports was equal to $257.719 million (see Figure 3).

South Korea is an important market for U.S. frozen pork (excluding processed). Twenty three percent of total U.S. exports of frozen pork (excluding processed) were shipped to South Korea from January to June 2017. South Korea imports of U.S. frozen pork represented 89.9% of its total U.S. pork imports during the first two quarter of 2017. Overall, from January to June 2017, U.S. shipments (to all destinations) of frozen pork represented 37.5 percent (486,140 MT CWE) of U.S. total pork exports (1.296 million MT).

According to the USDA, U.S. pork prices will continue to be price competitive in South Korea, mainly because of lower Korea-U.S. Free Trade Agreement duties. USDA’s April 2017 data indicates a 2 percent growth in South Korea’s pork consumption during 2017. Domestic pork consumption is expected to increase from 1.894 million MT CWE in 2016 to 1.931 million MT CWE in 2016. Projected 2017 pork production in South Korea is equal to 1.305 million MT CWE. South Korea pork imports (from all sources) are projected to expand 2.4 percent to 615,000 MT CWE in 2017 compared with 2016.

China/Hong Kong

China/Hong Kong imports of U.S. pork were down 22.3% to 135,056 MT CWE during January to June 2017. U.S. pork exports to China/Hong Kong during this period were valued at $196,071. The USDA’s April 2017 forecast for China’s imports (from all sources) during 2017 indicate a 5.5 percent increase to 2.300 million MT CWE compared with the previous year (2.181 million MT CWE).

Data compiled by the U.S. Meat Export Federation indicates China/Hong Kong is the largest importer of U.S. pork variety meats. U.S. exports during the first half of 2017 showed a volume of 172,269 MT valued at $367,156.

2017 Outlook

The latest USDA (August 2017) projections for U.S. total pork production in 2017 show a 3.5 percent increase to 11.705 million MT CWE year over year. 2017 U.S. pork exports are expected to increase 9.8% to 2.610 million MT CWE compared with the previous year.

USDA’s projections reported in April 2017 show the EU will continue as the top global pork exporter with a total volume of 3.300 MT CWE in 2017. This represents a 5.6 percent growth from the previous year. This projection is supported by pork imports from China, the largest global pork importer. EU pork production in 2017 (23.450 million MT CWE) is projected to be almost twice that of the United States. These projections indicate the EU will export 14.1 percent of its pork production in 2017, which is in contrast to 13.4 percent, the share of production exported by the EU in 2016.

The United States is projected as the second largest pork exporter in 2017. Canada and Brazil are expected to be the third and fourth largest pork exporters this year with projected exports at 1.300 million MT CWE and 0.900 million MT CWE, respectively.

U.S. pork export markets represent a growing importance for the U.S. pork sector as the volume exported is approaching a quarter of U.S. total pork production this year. Increased U.S. pork production, current competitive prices, and diverse markets demanding different cuts are factors supporting thriving U.S. exports this year to meet pork demand overseas.