USDA released the June 2020 Hogs & Pigs Report on June 25, 2020. Total inventory was up 5% from a year ago at 79.6 million head. The breeding herd was at 6.33 million head, down 1% from a year ago and market hog inventory was up 6% from a year ago at 73.3 million head. Of even more interest in the current situation were the weight breakdowns of the market hogs. The ‘over 180 lb’ group was up 13% compared to a year ago. The ‘120-179 lb’ group was up 12% from a year ago. The ‘50-119 lb’ group was up 3% from a year ago and the ‘under 50 lb’ group was slightly less than a year ago.

The weight breakdowns are especially important within the current situation for COVID-19 disrupted slaughter and processing markets. Prior to the report, my calculations indicated that there were 3.397 million head of hogs “backlogged” on farms due to reduced slaughter operations in March, April, May, and June. This is without consideration of “other disappearance” of these hogs through either farm slaughter, custom slaughter, or euthanasia. Normally, one would expect these “backlogged” hogs to show up in the heaviest weight group. And, to some degree, that did occur. With the ‘over 180 lb’ weight group up 13%, that indicates that about 1.359 million head were backed up into this weight group. But, it also appears that producers substantially slowed down the rate of gain on lighter hogs over the past three months and thus the ‘120-179 lb’ weight group was also up 12% from a year ago indicating that 1.225 million head of backlogged hogs were counted in this group in the June inventory report. This would suggest that a total of 937,000 hogs “disappeared” from the system through either custom slaughter, farm slaughter or euthanasia. This number is likely the largest disappearance that has ever occurred in a quarterly hog report. These numbers are supported by the anecdotal reports of huge backlogs at custom slaughter, much larger than normal farm and personal slaughter, and reports of significant euthanasia of both market hogs at facilities. They had all available markets shut down operations at the same time (especially in southwest Minnesota, northwest Iowa, and eastern South Dakota), as well as nursery pigs at others that had the capability to hold heavy hogs if they stopped the flow of new pigs into their systems. The large increase in the ‘120-179 lb’ group also is supported by anecdotal reports of “double loading” of nursery and growing barns and significant crowding of heavier hogs in finishing facilities.

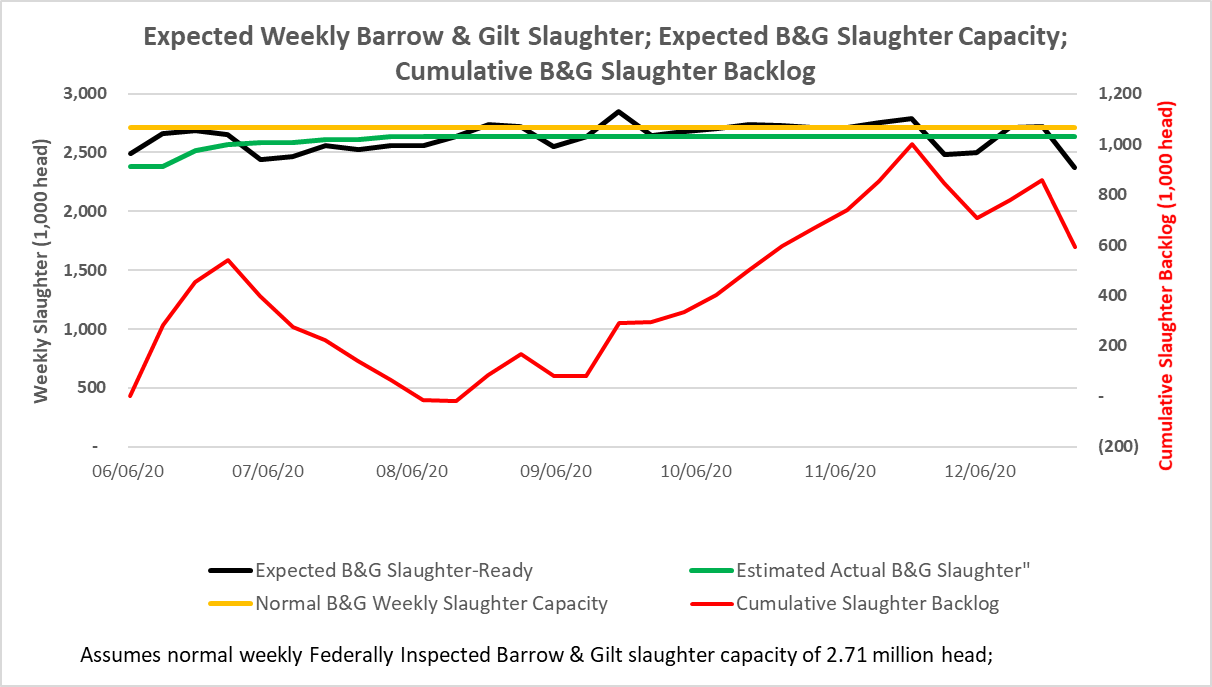

So, what do the next 6 months look like for the hog industry? For the month of June, total federally inspected hog slaughter averaged 93.4% of theoretical capacity, which is 2.71 million head per week. This level of capacity utilization is based on 502,000 daily slaughter capacity and a 5.4 day slaughter week. In June 2020, daily hog slaughter averaged 85% of capacity, but very strong Saturday slaughter operations brought the weekly totals to 93.4% of capacity. Early in June, daily slaughter was running about 81-85% on weekdays, but by the end of June, daily slaughter was running near 93% of capacity. It is unlikely that weekday daily slaughter can get back to 100% in the near term due to increased spacing of workers, and slightly slower chain speeds. Saturday slaughter is consistently running near 60% of daily capacity and with strong, continued Saturday slaughter runs it is possible that weekly slaughter can approach the 100% theoretical level.

Starting from June 1, 2020, Figure 1 shows expected weekly barrow and gilt slaughter, expected number of head ready for slaughter from the June Hog & Pig report, and the calculated cumulative backlog of slaughter hogs that could happen between now and the end of 2020. There is likely to be some slaughter backlog yet in July 2020, but much of that backlog should be worked through by Labor Day. The amount of slaughter-ready hogs increases for much of September, October, and much of November. Over the Labor Day to Thanksgiving period, it is likely that nearly 1 million more hogs will reach market-ready weight than there is slaughter capacity to process unless Saturday operations are pushed to near 100% of weekday capacity. Nevertheless, the number of backlogged hogs in the third and fourth quarters of 2020 are expected to be less than 30% of the levels seen in the second quarter of 2020.

Figure 1. Expected Weekly Barrow and Gilt Slaughter, Expected B&G Slaughter Capacity and Cumulative B&G Slaughter Backlog