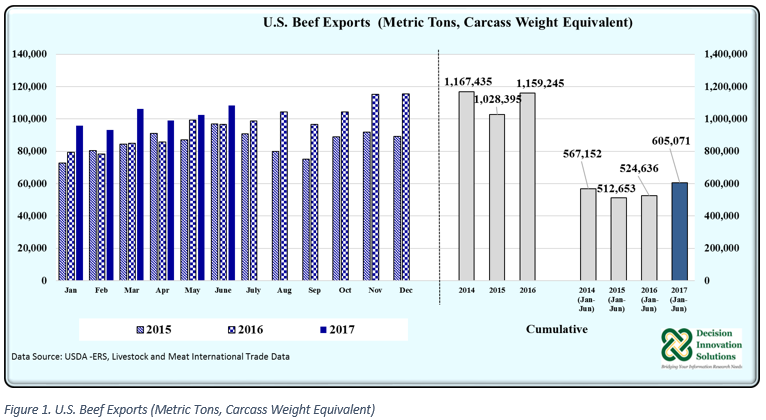

U.S. beef exports during the first half of 2017 increased 15.3 percent to 605,071 metric tons (MT) carcass weight equivalent (CWE) compared with the same period last year (524,636 MT CWE) (see Figure 1). The U.S. beef export volume so far (January to June 2017) is the second largest after the record high volume of 605,835 MT CWE in 2011. June 2017 registered the largest exports of the year with 108,230 MT CWE. Exports during June were up 12% year over year and 5.5% from the previous month.

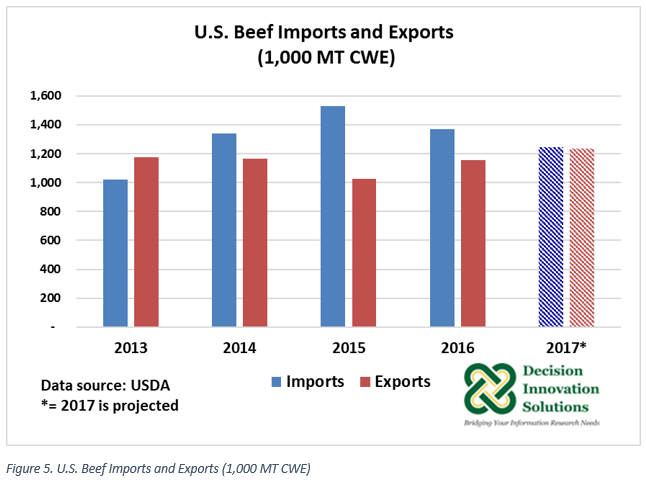

Large production volumes and lower U.S. beef prices are supporting exports this year. The latest (August 2017) USDA forecast indicates 2017 U.S. production will increase 5.9 percent to 12.1 million MT CWE year over year (11.4 million MT CWE). 2017 U.S. beef exports are expected to grow 8.9 percent to 1.263 million MT CWE compared with 2016. The export share of 2017 U.S. total beef production is forecast at 10.4 percent up from 10.1 percent, the share in 2016.

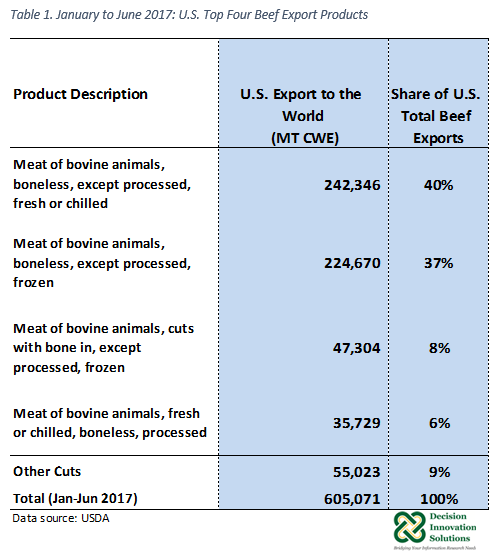

The top (by volume) U.S. beef commodities exported during the first half of 2017 were fresh/chilled boneless beef (except processed) and frozen boneless beef (except processed). U.S. exports of fresh/chilled boneless beef (except processed) represented 40.0 percent (242,346 MT CWE) of total U.S. exports (see Table 1). Exports of frozen boneless beef (except processed) represented 37.0 percent (224,670 MT CWE) of total U.S. beef exports during the first six months of 2017. In addition, 47,304 MT CWE of frozen cuts with bone in (except processed) and 35,729 MT CWE of fresh/chilled boneless beef (processed) were exported from January to June 2017, with a share of 8 and 6 percent, respectively, of all exports during this period (see Table 1).

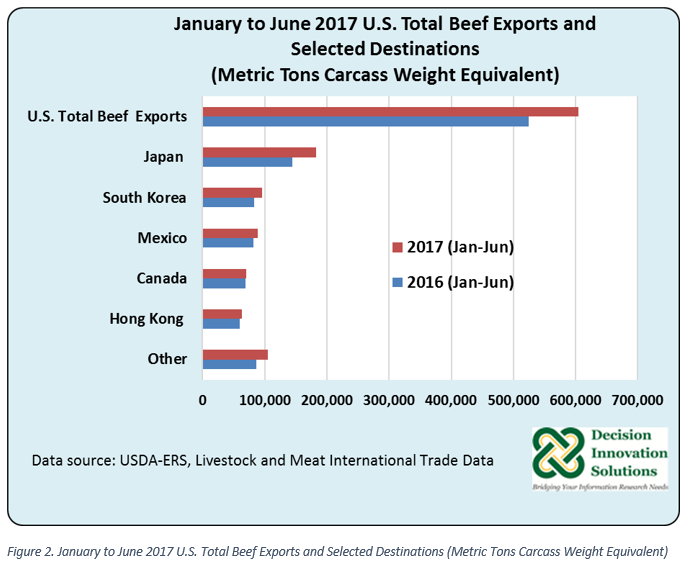

From January to June 2017, U.S. beef was exported to 111 countries but as Figure 2 indicates, the top five markets for U.S. beef were Japan, South Korea, Mexico, Canada, and Hong Kong. These five markets comprised 82.7% (500,565 MT CWE) of total U.S. beef exports (605,071 MT CWE) during the first half of the year. Exports to Other destinations represented 17.3% (104,506 MT CWE) of U.S. total beef exports from January to June 2017.

U.S. Beef Exports to Japan

Japan is the main destination for U.S. beef. From January to June 2017, the United States exported 182,474 MT CWE, making up 30.2 percent of U.S. beef export volume during this period. Exports to Japan during the first six months of 2017 were up 26.4 percent compared with the same period last year (144,335 MT CWE). Large U.S. beef production volumes and lower prices likely boosted exports to Japan during the first half of the year.

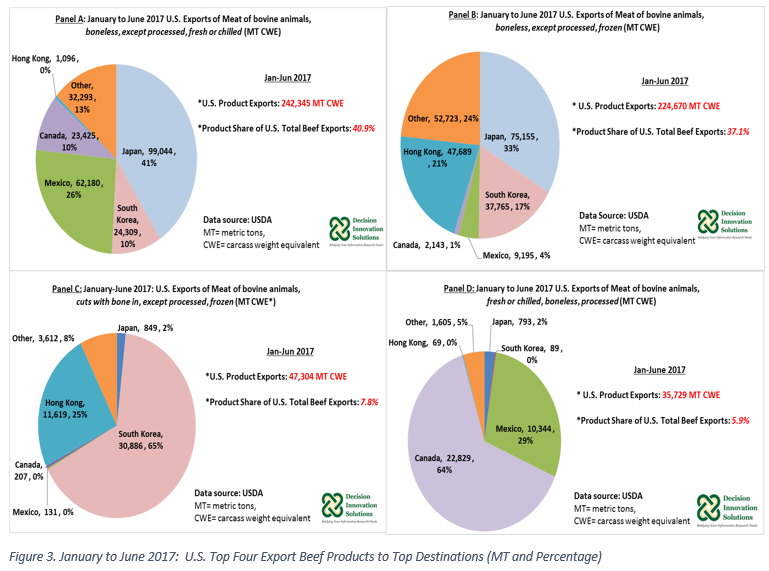

From January to June 2017, the United States exported 99,044 MT CWE of fresh/chilled boneless beef (except processed) ($501.7 million) and 75,155 MT CWE of frozen boneless beef (except processed) ($197.6 million) to Japan. These two products represented 54 and 41 percent, respectively, of Japan total volume of beef imports from the United States. These statistics show that 40 percent of U.S. total exports of fresh/chilled boneless beef (except processed) (Figure 3 -Panel A) and 33 percent of U.S. total exports of frozen boneless beef (except processed) (Figure 3- Panel B) were shipped to Japan during first six months of 2017. As indicated above, these have been the two main beef commodities exported by the United States during 2017 (January to June).

The lack of a Free Trade Agreement between the United States and Japan will affect U.S. beef exports to Japan for the rest of this year and the first quarter of 2018. According to a USDA’s report Tariff for Frozen Beef Rise as Special Safeguard is Applied, on August 1, 2017, Japan increased the duty for U.S. frozen beef from 38.5 percent to 50 percent based on Japan’s special safeguard (SSG) measure for frozen beef. This higher duty will be in effect until March 31, 2018, which marks the end of Japan’s 2017 fiscal year. The report indicates the SSG measure will only apply to countries that do not have Economic Partnership Agreement with Japan. Most of the frozen beef imported by Japan is from Australia and will not be affected by the SSG measure. Australia’s tariff for frozen beef will remain at 27.2 percent.

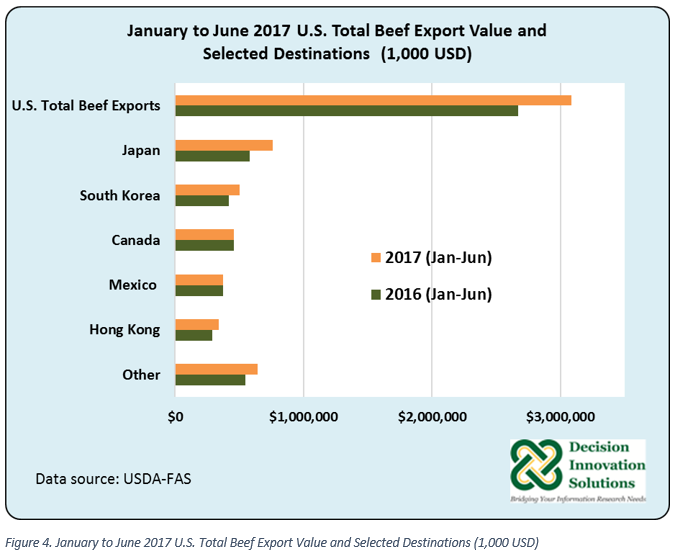

U.S. beef exports to Japan from January to June 2017, were valued at $759.3 million and represented a quarter of the total U.S. beef exports value during this period ($3.082 billion) (see Figure 4).

U.S. Beef Exports to South Korea

South Korea was the second largest volume (96,087 MT CWE) and value ($504.141 million) market for U.S. beef during the first two quarters of 2017 (see Figures 2 and 4), comprising 16 percent of both total volume and total value of U.S. beef exports during this time.

South Korea was the third largest market for both U.S. fresh/chilled boneless beef (except processed) (24,309 MT CWE) ($154.2 million) and frozen boneless beef (except processed) (37,765 MT CWE) ($153.9 million). South Korea’s market share was 10 percent for U.S. fresh/chilled boneless beef (except processed) (see Figure 3-Panel A) and 17 percent for U.S. frozen boneless beef (except processed) (see Figure 3-Panel B). Imports of these two commodities (combined) represented 65 percent of all U.S. beef imports by south Korea during the first six months of 2017.

South Korea also imported 30,866 MT CWE ($171.8 million) of frozen cuts with bone in beef (except processed) during the first six months of 2017. That made South Korea the number one market for U.S. frozen cuts with bone in beef (except processed) receiving 65 percent of total U.S. beef shipments of this beef commodity (47,304 MT CWE) during January to June 2017 (see Figure 3-Panel C).

According to USDA projections reported in April of this year, South Korea will import (from all sources) 535,000 MT CWE of beef in 2017, increasing 4.3 percent from last year (513,000 MT CWE).

U.S. Beef Exports to Mexico

U.S. beef exports to Mexico grew 7.9 percent in volume (88,630 MT CWE) during the first half of this year (2017), with exports in June (15,592 MT CWE) increasing 15.3 percent year over year. Mexico was the third largest volume market from January to June 2017 (see Figure 2). By value ($376.2 million), Mexico was the fourth largest market for U.S. beef, after Canada (see Figure 4).

From January to June 2017, the United States exported 62,180 MT CWE ($261.7 million) of fresh/chilled boneless beef (except processed) to Mexico, representing 70 percent of all the U.S. beef volume imported by Mexico. Twenty-six percent of the total volume exported by the U.S. of this commodity this year (January to June) was shipped to Mexico (see Figure 3-Panel A). Mexico was the second largest market for fresh/chilled processed boneless beef with 10,344 MT CWE ($50.3 million). Twenty-nine percent of the total volume of fresh/chilled processed boneless beef exported by the United States during the first two quarters of 2017 was shipped to Mexico (see Figure 3-Panel D).

According to USDA-FAS March 2017 projections, Mexico 2017 beef imports will increase 3 percent to 191,000 MT CWE from last year. The United States is the main supplier of beef to Mexico, supplying over 80 percent of this country beef import demand.

U.S. Beef Exports to Canada

Export to Canada marginally increased (0.9%) to 69,783 MT CWE ($458.6 million) during the first half of 2017. In terms of volume, Canada was the fourth largest market for U.S. beef. By value, Canada was ahead of Mexico. Thirty-four percent (23,425 MT CWE, $91.9 million) of Canada’s imports of U.S. beef were fresh/chilled boneless beef (except processed), while 33 percent (22,829 MT CWE, $142.2 million) were fresh/chilled boneless processed beef. As Figure 3-Panel D indicates, Canada was the number one market for fresh/chilled boneless processed beef, responsible for 64% of U.S. total volume exported of this beef product (35,729 MT CWE, $211.3 million) this year (January to June 2017).

U.S. Beef Exports to Hong Kong

U.S. beef exports to Hong Kong registered a volume of 63,590 MT CWE valued at $339.4 million. The volume of exports to Hong Kong increased 6.2 percent compared with the previous year (January to June 2016) (59,875 MT CWE) (see Figure 2).

Hong Kong was the second largest market for U.S. frozen boneless beef (except processed), responsible for 21 percent (47,689 MT CWE, $220.0 million) of the U.S. total volume exported of this product during the first six months of the current calendar year (see Figure 3-Panel B). Seventy five percent of Hong Kong imports of U.S. beef consisted of U.S. frozen boneless beef (except processed).

U.S. Beef Exports to Other Markets

Exports to Other markets outside the top five major U.S. beef export markets so far this year (January to June 2017), grew 21.6 percent (year over year) to 104,506 MT CWE from 85,943 MT CWE. The value of U.S. beef exports to these other markets ($644.3 million) represented 21 percent of the total value of U.S. beef export during the first half of 2017 (3.081 billion). The exported volume of U.S. fresh/chilled boneless beef (except processed) (32,293 MT CWE) and U.S. frozen boneless beef (except processed) (52,723 MT CWE) to Other destinations represented 13 percent and 24 percent, respectively, of U.S. total exports of each of these commodities (see Figure 3-Panel A and Figure 3-Panel B).

U.S. Beef Outlook

The United States is projected to be the number one beef producer in the world with 12.1 million MT CWE in 2017 (up 5.8 percent year over year) (WASDE, August 2017). At the same time, the United States is projected to be the largest consumer and importer of beef this year. According to USDA (WASDE, August 2017), U.S. domestic beef consumption is expected to increase 4.9 percent year over year to 12.2 million MT CWE. U.S. beef imports, on the other hand, are forecast to decline 6.1 percent to 1.285 million MT CWE. With the projected level of exports this year (1.263 million MT CWE), despite the expected decline in U.S. beef imports, the United States will continue as a net beef importer. If these projections are realized, the gap between imports and exports would amount to about 9,000 MT CWE (see Figure 5). The U.S. is projected as the fourth largest beef exporter, after India (1.850 million MT CWE), Brazil (1.8 MT CWE), and Australia (1.4 MT CWE).

Note:

By the time we are posting this report, USDA-ERS published new beef export data for the month of July 2017. U.S. beef exports from January to July 2017 were up 14.5 percent to 713,646 MT CWE compared with the same period last year (623,329 MT CWE). Exports during July 2017 added 108,575 MT CWE to the volume of shipments during January to June 2017 (605,071 MT CWE).

U.S. beef exports to the top five markets increased from January to July 2017 compared with same period in 2016. Exports to Japan were up 25.7 percent to 216,359 MT CWE, whereas exports to Korea increased 12.6 percent to 114,370 MT CWE. In addition, exports to Mexico (104,821 MT CWE), Canada (82,180 MT CWE), and Hong Kong (73,497 MT CWE) were up 6.5 percent, 1.6 percent, and 9.2 percent, respectively. U.S. beef exports to these five markets during the first seven months of 2017 (591,226 MT CWE) represented 82.8 percent of total U.S. beef exports during this period.