The blending of ethanol into gasoline contributes to meet the Renewable Fuel Standard obligations established in the Energy Independence and Security Act of 2007. E10 is the most commonly fuel sold in the U.S.

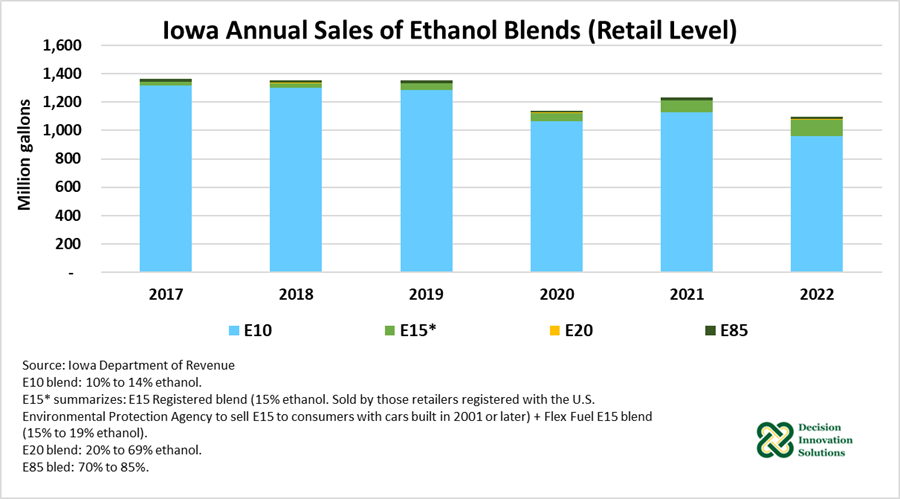

Based on the latest annual retail fuel sales data published by the Iowa Department of Revenue, Iowa ethanol total sales of all blends combined were estimated at 1.098 billion gallons in 2022, down 11% from 2021 (1.234 billion gallons). Iowa sales of E10[1] made up 87.2% (958.236 million gallons) of total ethanol blend sales (see Figure 1).

Figure 1. Iowa Annual Sales of Ethanol Blends (Retail Level)

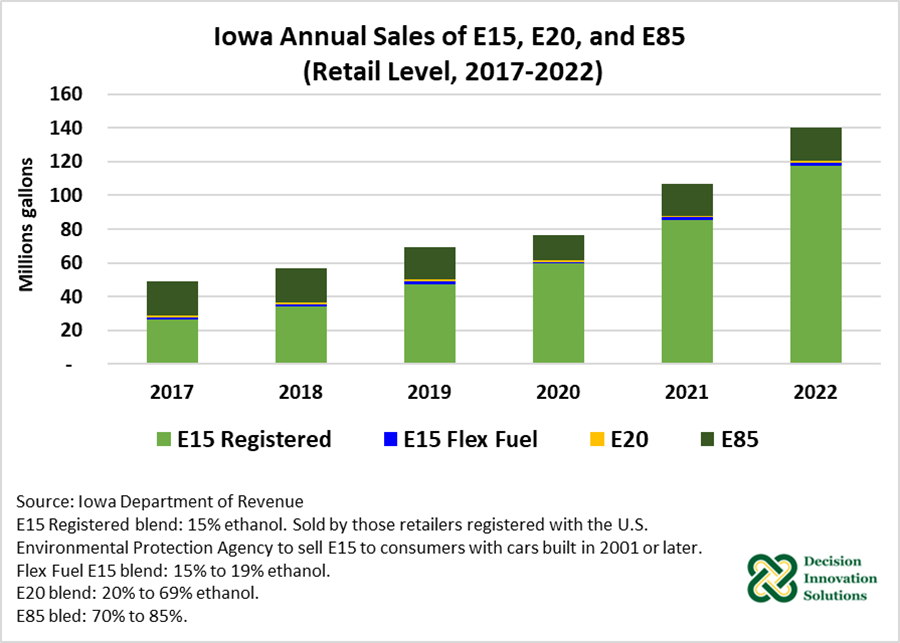

Other ethanol blends sold in Iowa include E15, which encompasses Registered E15 and Flex Fuel E15. Registered E15, which is a blend of gasoline and ethanol that contains 15% ethanol, is dispensed by retailers registered with the U.S. Environmental Protection Agency to sell E15 to consumers with vehicles manufactured in 2001 or after, enabling E15 sales the entire year. Flex Fuel E15, which comprises ethanol blends containing between 15% to 19% ethanol, includes gallons sold by retailers through a blender pump during the year. Other ethanol blends sold in the state include E20 (20% to 69% ethanol) and E85 (70% to 85% ethanol).

Although Iowa sales of E10 dropped 14.9% (168.300 million gallons) to 958.236 million gallons in 2022 from the volume in the previous year and down 27.1% from 2017, sales of higher ethanol blends increased year-over-year. E15 sales were up 37.4% to 119.429 million gallons, with registered E15 accounting for 98.3% (117.411 million gallons) of total E15 sales. Compared with 2017, Iowa sales of E15 grew 331.0% (91.7 million gallons) in 2022 (see Figure 2). In addition, relative to a year earlier, 2022 Iowa sales of E85 and E20 increase 1.8% (to 19.614 million) and 27.0% (to 1.186 million gallons), respectively.

Figure 2. Iowa Annual Sales of E15, E20, and E85 (Retail Level, 2017-2022)

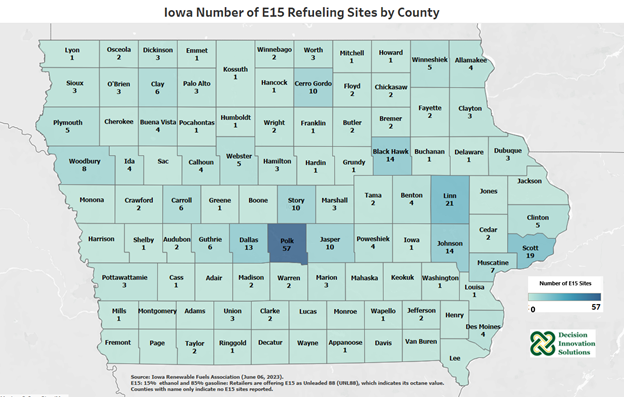

Data from the Iowa Renewable Fuels Association (IRFA) indicates that as of June 6, 2023, there were 342 E15 registered refueling sites in Iowa, up from 243 on July 15, 2022. The county with the most E15 refueling sites is Polk County with 57 sites (up from 43 sites a year earlier). Counties with 10 to 21 sites include Linn (21 sites), Scott (19 sites), Johnson and Black Hawk each one with 14 sites, Dallas (13 sites), Jasper, Story, and Cerro Gordo each one with 10 E15 registered refueling sites (see Figure 3). As of June 6, 2023, there were 78 Iowa counties with E15 refueling sites, up from 66 last year.

One of the incentives for fuel retailers to offer higher biofuel blends is the Iowa Renewable Fuels Infrastructure Program (RFIP), which offers retailers cost-share grants to convert their equipment to allow for the sale of higher biofuel blends. Grants can be up to $50,000.

In terms of tax credits, there is the Mid-Level Ethanol Blend Retailer Tax Credit[1]. Retail stations supplying ethanol blends between 15% (E15) and 69% (E69) for use in motor vehicles may be eligible for a tax credit. Credit amounts differ by date. This tax credit will expire on December 31, 2024. In addition, under the E85 Retailer Tax credit, retail stations dispensing E85 for use in motor vehicles may be eligible for a tax credit of $0.16/gallon sold. This tax credit expires after December 31, 2027. Eligible taxpayers may claim both Mid-Level Ethanol Blend Retailer Tax Credit and the E85 Retailer Tax Credit during the same tax year.

Figure 3. Iowa Number of E15 Refueling Sites by County

Last year the U.S. Environmental Protection Agency (EPA) used its emergency waiver authority to waive the 9-psi Reid vapor pressure (RVP) limitation for gasoline blended with 15% ethanol for the 2022 summer ozone control season, which provided fuel market certainty for that period.

On April 28, 2023, once again EPA granted an emergency fuel waiver to allow E15 to be sold during the summer driving season. With this emergency fuel waiver, retailers can dispense E15 beyond May 1 and into the summer months. This action expands fuel supply and gives consumers more choices at the pump and price flexibility in the near term. April 2023 estimates indicated that on average E15 was about 25 cents per gallon cheaper than E10. E15 registered is sold at retail level as Unleaded 88 (UNL88) to indicate the octane value (88) of this fuel, which is higher than E10 blend, which has an octane value of 87.

Still pending (as of Aug 1, 2023), is the EPA action to finalize its proposed rule to approve the Midwest Governors’ Year-Round E15 fix in the states of Iowa, Nebraska, Illinois, Kansas, Minnesota, North Dakota, South Dakota, and Wisconsin. This would allow for both E10 and E15 to have the same summer regulations, which would entail year-round sale of E15 on a permanent basis.

Economic analysis provided by Patricia Batres-Marquez, Senior Research Analyst, Decision Innovation Solutions on behalf of Iowa Farm Bureau.

[1] Ethanol E10 blend: 10% to 14% ethanol.

[2] Alternative Fuels Data Center: Iowa Laws and Incentives (energy.gov)