Introduction

Most of us have noticed egg prices at the grocery store are extremely high. In fact, in 2022 egg prices increased 60% according to the US Bureau of Labor Statistics. While inflation contributed to this increase, the continuing HPAI outbreak has also been a factor.

HPAI Case Numbers

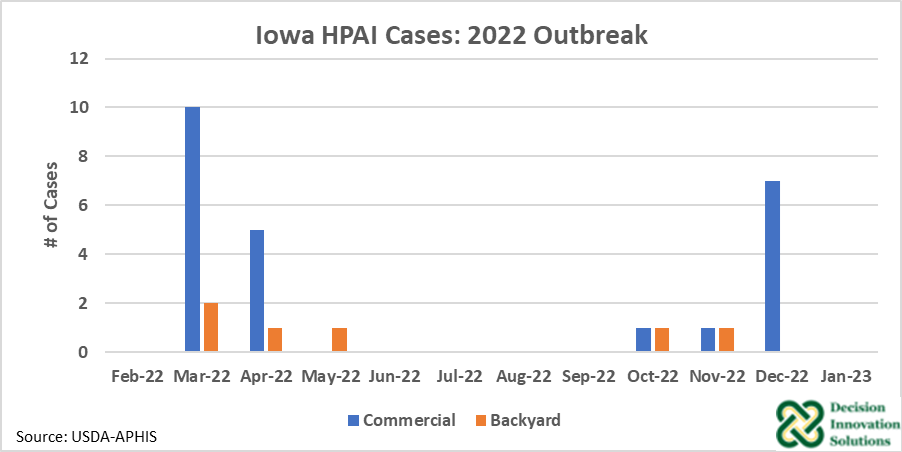

Earlier this year it looked like the 2022 Highly Pathogenic Avian Influenza (HPAI) outbreak might die down. Iowa, a major egg producing state, went through a four-month period over the summer with no new cases (Figure 1). Enough time passed that for a while IDALS had no commercial farms under HPAI quarantine restrictions.

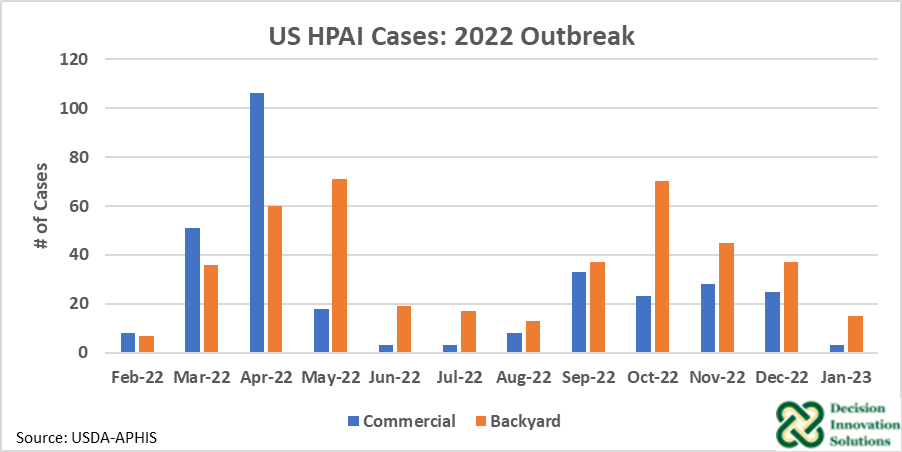

Cases were still being identified in other states in the summer months, but not at the volume they had been earlier in the year (Figure 2). Furthermore, during the last HPAI outbreak in 2015, the last reported detection date was June 16, 2015. An optimist might have thought the 2022 outbreak would follow a similar pattern.

Unfortunately, the 2022 outbreak has continued well past the summer. Cases picked back up in the fall of 2022. Across the US cases are still being identified almost a full year after the first case in the 2022 outbreak was identified last February. As of January 23, 2023, 57.89 million birds in 47 states have been affected by the 2022 HPAI outbreak.

Figure 1. Iowa HPAI Cases: 2022-2023 Outbreak

Figure 2. US HPAI Cases: 2022-2023 Outbreak

Egg Industry Statistics

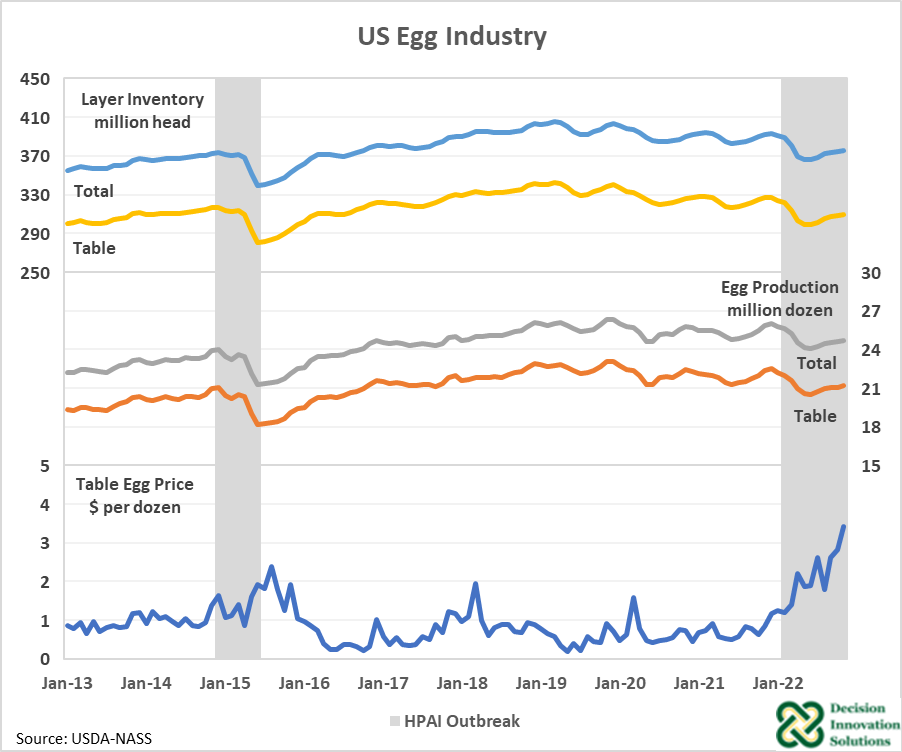

As HPAI cases have persisted, the recovery of layer inventory and egg production to pre-outbreak levels has slowed as well. Figure 3 shows statistics for the US Egg industry including layer inventories, egg production, and egg prices received by producers. HPAI outbreaks are also shaded. In the graph, “table” indicates eggs or layers who lay eggs for human consumption, while “total” includes eggs or layers who lay eggs to be hatched.

Layer inventories rapidly declined in February 2022 at the onset of the outbreak and hit their bottom in June 2022. Inventories rose slightly over the summer and early fall of 2022, recovering about 25% of the decline from pre-outbreak levels. However, growth in inventories stalled out in September as HPAI cases began to return in greater numbers. Egg production mirrors layer inventor, hitting a bottom in June 2022 and then showing a slight recovery that slowed in September.

Though inventories and prices have rebounded slightly, egg prices have not yet shown signs of recovery. Even though supply of eggs was higher in November and December relative to the summer months, demand for eggs also increased. Egg demand typically increases around the holidays as demand for things like baked goods increases and this year was not an exception. The increase in demand was larger than the increase in supply and drove prices higher. The November 2022 table egg price was a record high of $3.43 per dozen. Given US retail egg inflation increased in December, it’s a good bet the December price will be even higher when it is released.

Figure 3. US Egg Industry

Looking Ahead

The 2015 HPAI outbreak started in December 2014 and ended in June 2015. The 2022 outbreak has lasted much longer and still has not shown signs of slowing down.

Layer inventory and egg production showed brief signs of recovery in the late summer of 2022 but a resurge in cases has slowed that recovery. Meanwhile, egg prices have only continued higher as increased demand around the holidays has been more than enough to offset slight recoveries in production.

Moving forward, some price declines may come in the 1st quarter of 2023 as holiday demand wears off, but how HPAI impacts the flock will also be important to monitor. A decline in egg production due to a resurgence in cases is not out the question and could keep prices at record levels.

Until the HPAI ends, prices will likely be higher than normal. If the outbreak does end, the industry showed after the 2015 outbreak it can recover relatively quickly. After the 2015 outbreak, egg prices reached more normal levels roughly six months after the outbreak ended and layer inventories and production had completely recovered in only nine months.