The spread of COVID-19 has created disruptions in livestock slaughter facilities. At the first of April, hog slaughter facilities began to operate at less than capacity. The first hog plant to close was the Tyson plant at Columbus Junction, IA which closed on April 6, 2020. It was closed for two weeks. Since then, pork plants at Waterloo, IA, Sioux Falls, SD, Worthington, MN, Windom, MN, Logansport, IN, and Delphi, IN have closed. By early May, daily slaughter had dropped to 60% of normal. The good news is that in March 2020 it appears that slaughter was about 200,000 head more than anticipated as processors sought to fill new retail demand.

The stoppage of slaughter at temporarily closed plants and slowdowns in slaughter rates at operating plants due to increased “distancing” on the processing lines and employee absenteeism is resulting in a backlog of hogs waiting for slaughter, even as more hogs reach slaughter weight on a daily basis. By early May, the 7-day moving average of daily hog slaughter backlog has reached 170,000 head per day. It is estimated daily backlog buildups could reach 240,000 head. Cumulatively, by May 9th, it is estimated that 2.1 million hogs were in the slaughter backlog with that backlog continuing to grow daily.

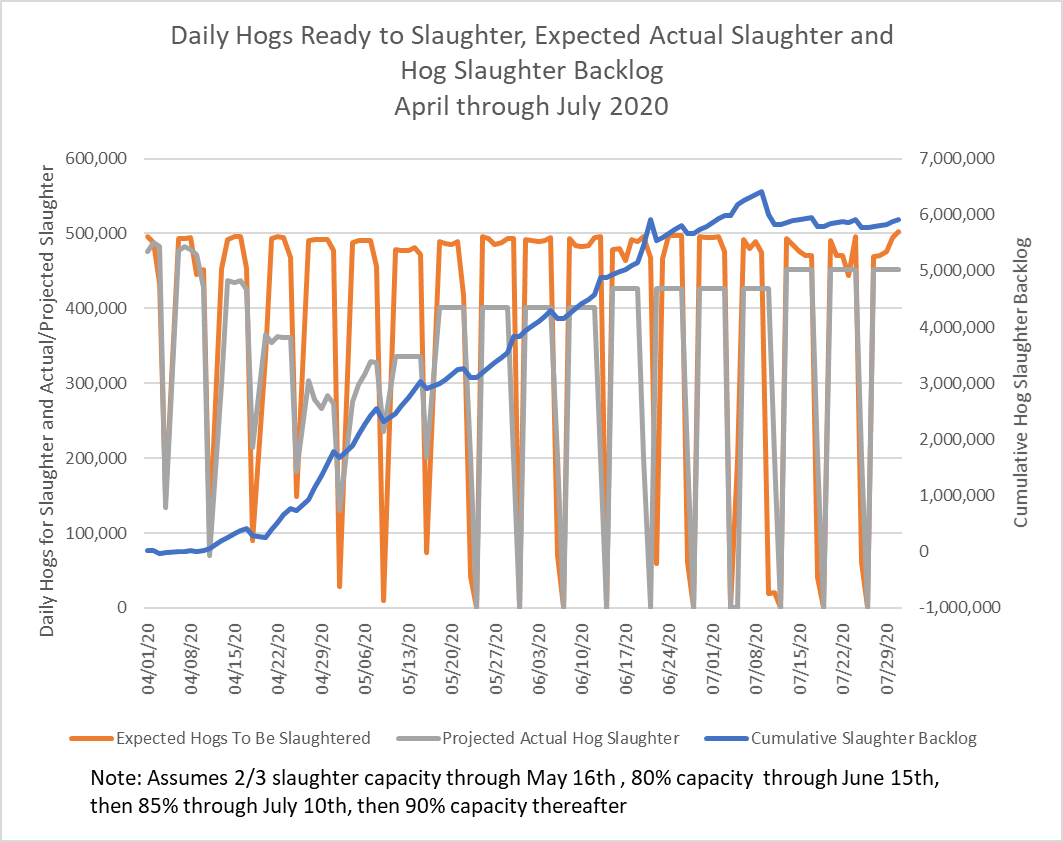

This graph shows estimates for hogs that are projected to be ready for slaughter on a daily basis, the estimated number of hogs that can actually be slaughtered given the impacts of Covid-19 on packing plant capacity, and the growing backlog of “hogs that have reached slaughter weight but have not been able to be slaughtered.”

This graph uses the March 2020 Hogs & Pigs Report to estimate projected hog numbers on a daily basis. The March report indicates that market hog inventory was 4% larger than a year ago with 6% more hogs in the 180+ pound weight group, 3.9% more in the 120-179 lb weight group, 3.6% more hogs in the 50-119 lb weight group, and 4% more hogs in the under 50 lb weight group.

It assumes a full slaughter capacity of 502,000 head per day; 67% slaughter capacity through May 16th, then 80% slaughter capacity through June 15th, 85% slaughter capacity through July 10th, and 90% capacity through the end of July. As can be seen in the graph, if hog slaughter capacity remains restricted as noted above there will be more than 6 million hogs that will be in the hog slaughter backlog by the end of July. Some reduction of this hog slaughter backlog can occur by running larger Saturday and Sunday shifts, but prior experience tells us that is extremely hard to maintain from a worker perspective.

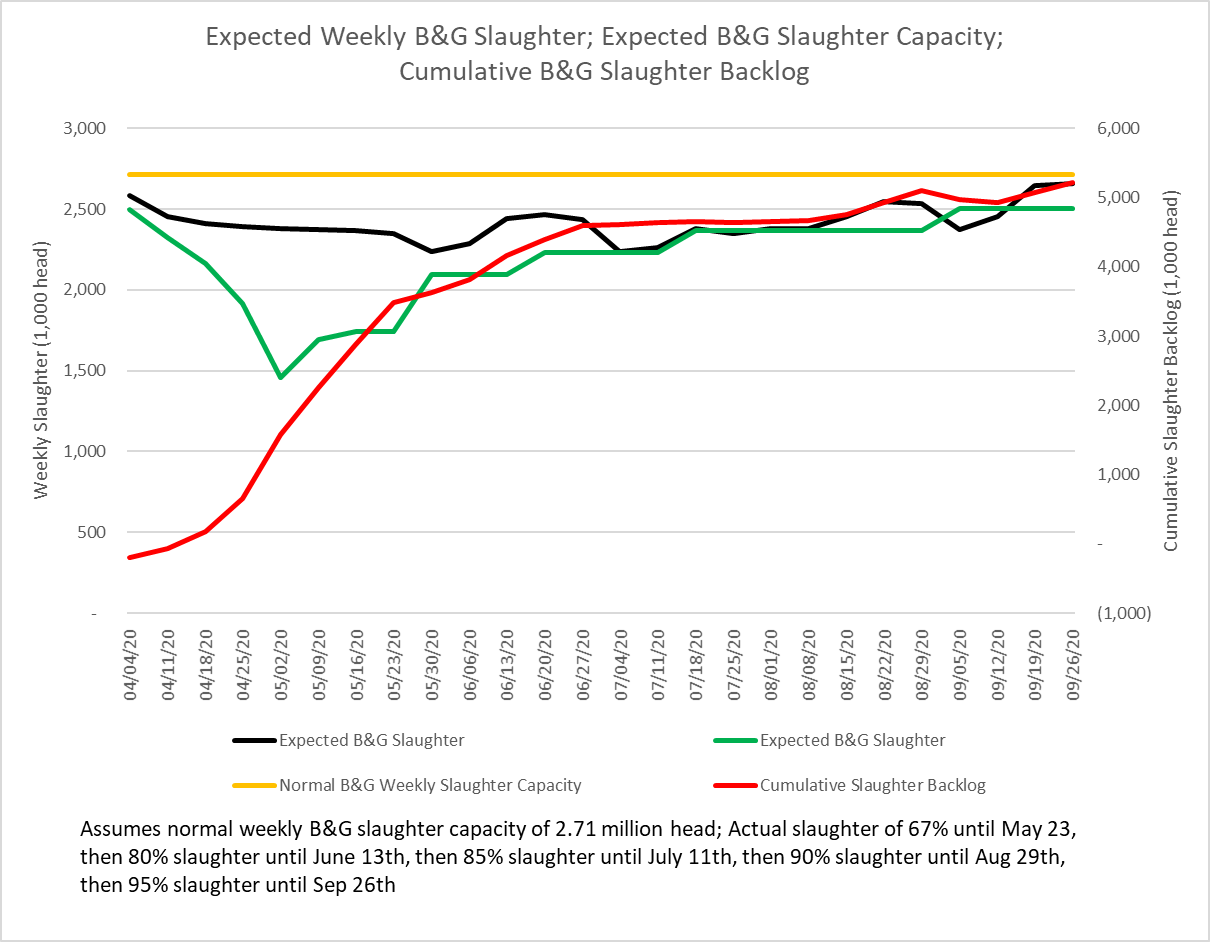

A weekly model of capacity, slaughter-ready barrows & gilts (B&Gs), anticipated slaughter levels, and the cumulative slaughter backlog of B&Gs has also been developed. This model assumes 2.71 million head normal slaughter capacity for B&Gs, anticipated slaughter levels as listed on the graphic, and expected slaughter-ready B&Gs and cumulative backlog through the end of September. Expected slaughter-ready B&Gs is modeled from the March Hog & Pigs report and 2019 slaughter patterns and assumes no market-ready hog euthanasia. To the extent that those happen, that will reduce the cumulative backlog. This model also assumes regular Saturday runs at 40% of normal daily capacity. The weekly model suggests a slaughter backlog of 5 million head by the end of July and about 6 million head by the end of September.