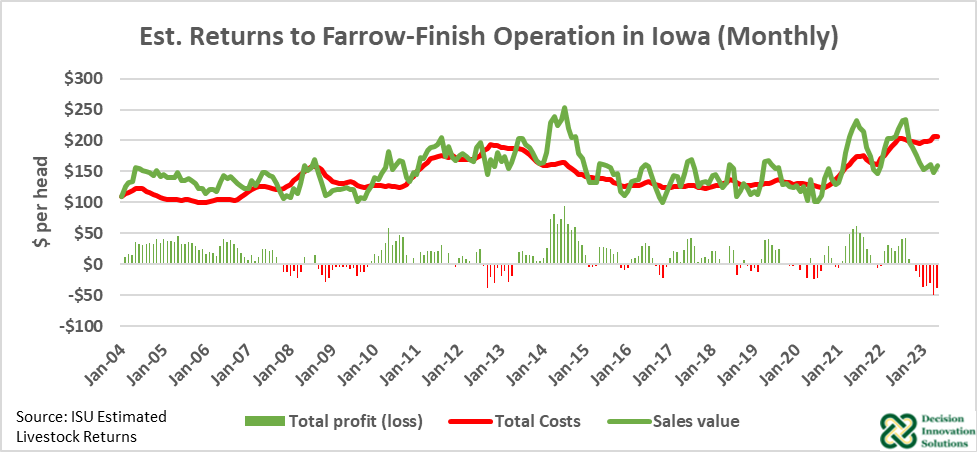

Lower hog prices and high costs have kept estimated hog returns negative for most of 2023 so far. Iowa State University publishes monthly estimates of costs and returns to livestock production, including various aspects of hog production. Note these are industry-wide estimates and do not necessarily reflect the returns of any individual operation.

Figure 1 shows revenue costs and returns for a farrow to finish operation. Hog production costs throughout 2023 have been much higher than in previous years. Corn and other non-feed variable costs are the largest contributors to the rise in estimated costs, though other categories are up as well. Even as prices have come down from highs last summer, costs continued to rise, turning average hog returns negative.

Figure 1. Estimated Returns to Farrow-Finish Operation in Iowa

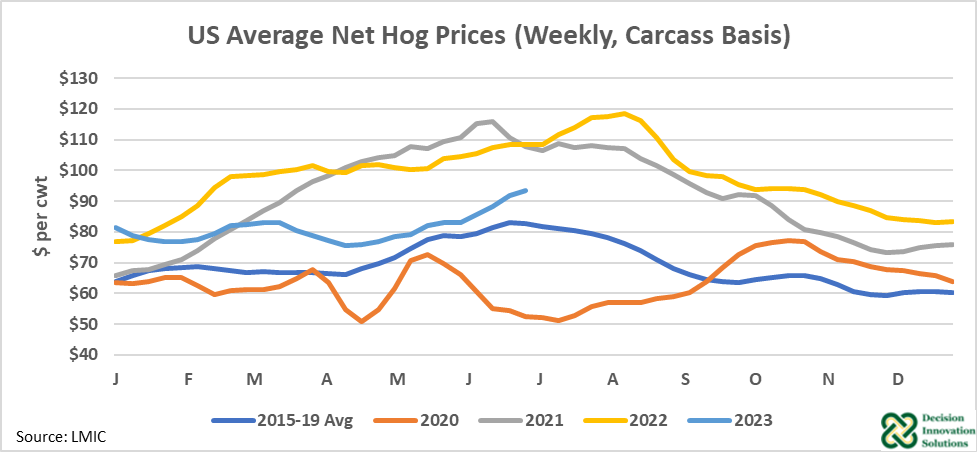

Hog prices are typically seasonal, increasing in the summer months (Figure 2). COVID-19 created an exception to this rule in 2020, but most other years follow this pattern. 2021 and 2022 had exceptionally large seasonal swings, with relatively high hog prices in the summer months. These prices were enough to cover higher costs in 2022, but only briefly. Prices cycled back down while costs stayed higher, creating a difficult situation for producers.

Figure 2. US Average Barrow & Gilt Prices

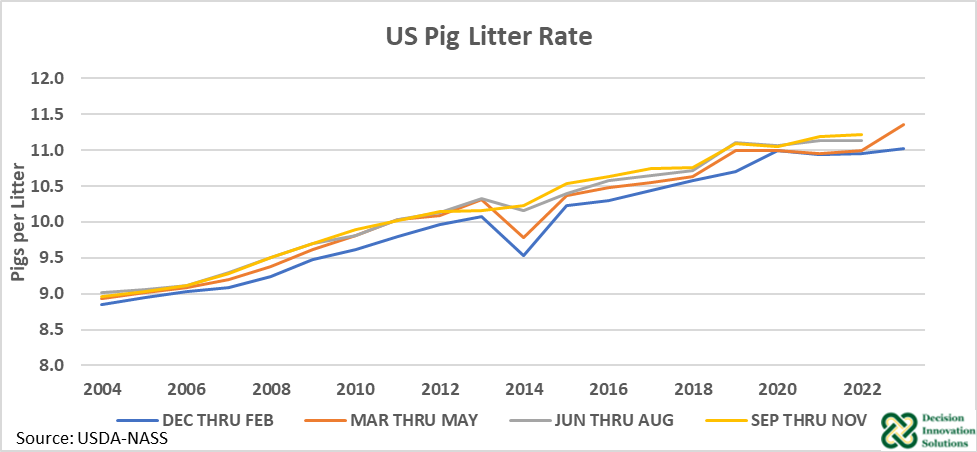

The recent USDA hog inventory report doesn’t look to provide much relief for producers. Total hog inventories were up slightly from last year. Furthermore, despite farrowing fewer sows this past quarter’s pig crop was up 1% over the same quarter last year. This was due to a record litter rate. US hog litter rates had had relatively little growth since 2020 but this past quarter’s rate may indicate the litter rate is about to start growing again.

Figure 3. US Pig Litter Rate

Slightly higher inventories and a strong pig crop add up to a supply that doesn’t look to be decreasing in the short run. Looking ahead at futures contracts, October and December prices are below the nearby August contract prices. As mentioned above, this seasonal price decrease into the fall and winter months is typically of hog prices. Unless a large supply or demand shock occurs, or feed costs come down considerably, it looks like hog producers will continue to face difficult margins in the short run.