Future growth in ethanol demand will mainly depend on the development of a long-term policy framework driven to create innovative ethanol consumption programs, such as E15, midlevel blends, and E85 blends. Use of intermediate blends are needed to increase the amount of ethanol consumption in the domestic fuel market to meet the Renewable Fuel Standard (RFS).

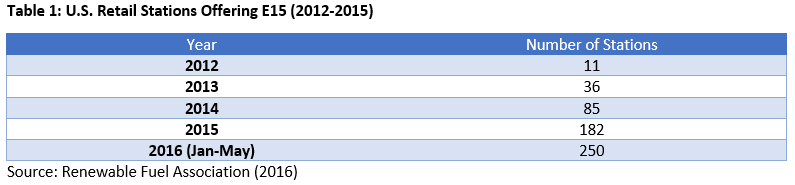

E15 is gasoline blended with 10.5% to 15% ethanol. E85 is 70% to 85% ethanol and 15% to 30% gasoline. E85 blends may vary seasonally and geographically. Growth in E15 has been slow as there are so many regulation bottlenecks. However, interest in E15 is increasing. The Renewable Fuel Association tracks the number of stations offering E15 and E85 fuel blends in the United States. There are 250 fuel stations offering E15 blends in the U.S. as of May 2016. The first station was opened in July 2012 in Lawrence, Kansas; there are now 23 states offering E15 blends. The number of U.S. stations offering E15 fuel blends increased by 114% from 2014 to 2015 (See Table 1).

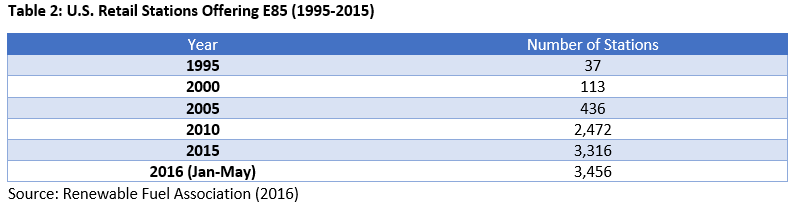

There are 3,456 fuel stations offering E85 blends in the U.S. as of May 2016. The number of U.S. stations offering E85 fuel blends increased by 34% from 2010 to 2015 (see Table 2). Current E85 stations as well as E85 prices are published in the RFA station locator found at www.E85prices.com.

The RFS stipulates that transportation fuel should contain 36 billion gallons of biofuels by 2022. The total demand for U.S. fuel ethanol comes mainly from domestic consumption through blending with gasoline with some coming in part from exports. Given the lack of growth in export markets, future growth in ethanol demand should come mainly from an expansion in domestic ethanol consumption. The use of higher blends, such as E15, is the only way the volume of ethanol can increase in the gasoline supply. To accomplish this an effective long-term plan is needed. A more detailed discussion on domestic demand for ethanol can be found in the Iowa State University’s AgMRC Newsletter.