The United Auto Workers (UAW), a union of American automobile manufacturing workers, has recently reached a deal with the “big three” US-based automakers: General Motors, Ford, and Stellantis. The tentative agreement includes a 25% pay increase for workers among other benefits. This agreement was reached after weeks of strikes that at times involved as many as 45,000 workers at several factories and distribution centers.

By their very nature as a stoppage of work, strikes have a negative impact on the economy. But how large is this impact?

One factory affected by these strikes was the Kentucky Truck Plant in Louisville. According to IMPLAN, this factory has an annual output of nearly $13.0 billion. Of this amount, around $1.7 billion is value added (equivalent to GDP) while around $11.3 billion is intermediate inputs (components and supplies received from other Ford factories or other businesses). Dividing this annual total into a daily amount is difficult. Factories operate on a variety of schedules; some operate for extended hours four days per week, some operate 5 days per week, and others run nearly 24/7. Assuming that this factory runs on a schedule of 5 days per week and 260 days per year, the estimated daily output of this factory is roughly $49.9 million.

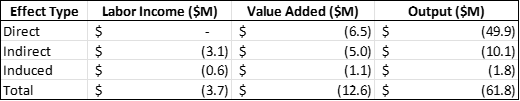

Table 1 shows the estimated economic impact of a 1-day stoppage at the Kentucky Truck Plant at the county level. The initial loss of $49.9 million in output results in an additional loss of $11.9 million in output, $6.1 million in value added, and $3.7 million in labor income when accounting for indirect and induced effects.

Table 1. Estimated Economic Impact of 1-Day Factory Stoppage

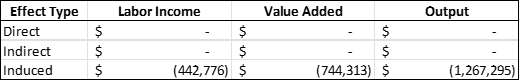

In addition to the factory shutting down, workers are also paid less during a strike. Striking UAW workers receive $100 per day in strike pay. The average auto worker in the US makes approximately $28 per hour, or $224 per 8-hour workday, resulting in a daily income deficit of $114 per worker. With the Kentucky Truck Plant employing 8,700 workers, each day of the strike means a loss of around $1.1 million in labor income. This initial loss of income results in an estimated further loss of $443,000 in additional labor income, and nearly $1.3 million in total sales or output (Table 2).

Table 2. Estimated Economic Impact of 1-Day Loss in Striking Workers’ Income

These values should be interpreted as rough estimates and taken with a grain of salt. Since IMPLAN is a static model based on annual production data, it is not built to estimate the effects of short-term disruptions like a brief strike. For example, many striking workers likely supplemented their income with money taken from their savings (that they will replenish with their now-higher wages), reducing the impact of lost wages. Similarly, the lost factory production may be made up later with extra shifts. On the other hand, the on-and-off strike strategy used by UAW may have been particularly disruptive to Ford’s supply chain, resulting in a higher economic impact than the IMPLAN estimate.