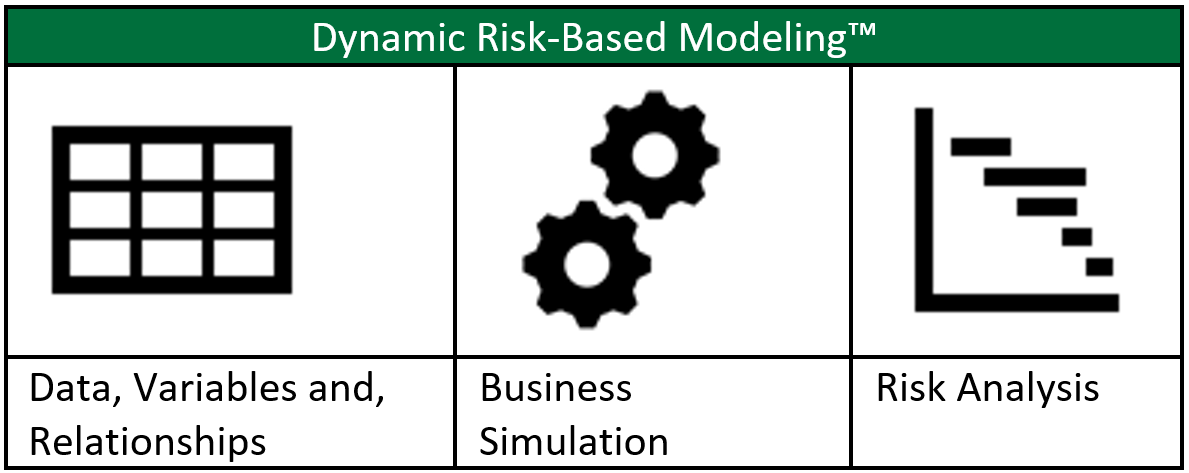

For some time, Decision Innovation Solutions has been the holder of a trademark dealing with what we’ve termed “Dynamic Risk-Based Modeling™”. Over the years we have used this modeling technique to better understand the risks associated with a given business or, more specifically in some cases, parts of businesses. Examples of practical uses of this modeling technique include:

- Livestock farms, such as dairies

- Renewable fuel production plants, such as biodiesel and ethanol plants

- A soybean crushing facility that was being considered as an integral part of (supplying the soybean oil) a biodiesel production plant

The common theme in these few examples is that each of them have an overall (enterprise) risk profile that is dependent upon any number of independent variables, each of which have their own risk profiles. Many of the key variables in a business are related to each other in some way. “Some way” could be defined as:

- Tightly or loosely

- Positively or negatively

- Simply related (i.e., correlated but not actually having an impact on other variables) or impacting other variables in a meaningful way

Identifying, quantifying and maintaining historical relationships among variables allows DIS to develop projections that provide our clients decision-making tools that help them understand how their risk appetite corresponds to certain levels of quantified risk associated with various defined scenarios. Almost without exception, our projections will drive to a set of financial statements so the identified risks can be understood from a financial standpoint.

With us now more than six months into the COVID “adventure”, we are seeing a greater need for this service. For example, as we saw most acutely in May 2020, some food processors (i.e., meat) had a difficult time keeping their supply chains active, causing slowdowns, which in turn led to disruptions in food availability in grocery stores. While the worst part of that specific challenge appears to be close to stabilization, if this situation either deteriorates or is repeated, what can be done now to mitigate the risk?

With the negative financial impact many livestock farmers experienced during Summer 2020 (which persists for many), there is a strong desire to have more control over the processing of their animals. This could lead to groups of farmers banding their financial resources together to build their own highly automated processing facility that could then sell a branded product. Given the backgrounds of the DIS team and our ability to practically use the Dynamic Risk-Based Modeling™ framework, we are naturally suited to handle a need such as this.

While we are surrounded by great uncertainty in many aspects of our lives, we look forward to opportunity to work with clients to identify, quantify and mitigate their risks so they can confidently move forward.

For additional background on the Dynamic Risk-Based Modeling™ and an example of its use in the dairy industry please see this link.