In both October 2022 and April 2023, OPEC+ announced cuts to its oil production. The October cuts totaled 2.0 mb/d and the April cuts totaled 1.16 mb/d. These were in addition to an announcement by Russia in February 2023 that it would be cutting its production 500,000 b/d moving forward.

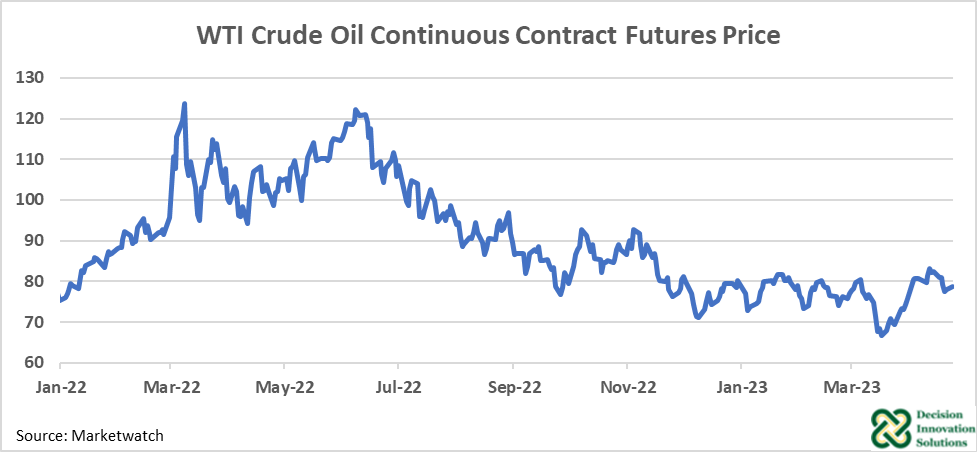

US Energy Information Administration’s (EIA) most recent data showed world production totaled 100,261 mb/d in December 2022, so the most recent cuts in February and April accounted for over 1% of world production. Almost immediately following the April announcement, crude oil prices increased about $5 per barrel. Prices remain well below levels seen last spring and summer when the Russia invasion of Ukraine and strong world demand following the pandemic worked together to drive prices to over $120 per barrel.

Figure 1. WTI Crude Oil Spot Prices

The recent OPEC+ production cut and the quick jump in oil prices caused concern prices to be headed that way again. While a possibility that is not a guarantee. We know oil supplies will be lower than expected for the remainder of the year, but the big question moving forward will be world oil demand.

Current projections have world demand increasing in 2023. The International Energy Agency (IEA) regularly projects world oil supply and demand. Their most recent April forecast sets world oil demand totaling 101.9 mb/d in 2023. This would be an increase of 2 mb/d compared to the IEA’s estimate for 2022.

The IEA’s notes that forecasted increases in oil demand are not uniform across countries. Members of the Organization for Economic Co-operation and Development (OECD), which includes the US, Japan, many European countries, and other countries as well, are not expected to have a large increase in demand for oil. Warmer weather and slower industrial use slowed demand in these countries in the first quarter of 2023 and large increases in demand the remainder of the year are not expected to offset this slow start.