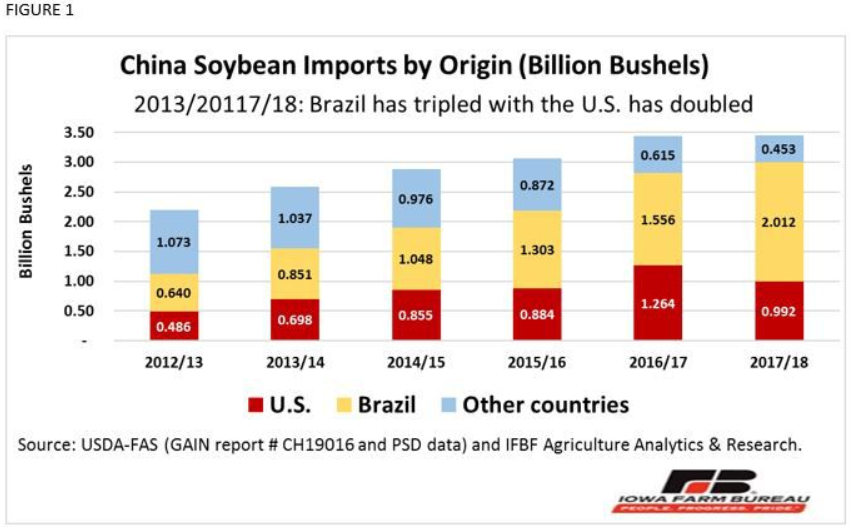

Until this marketing year, China had been the main foreign market for U.S. soybeans. However, Brazil has taken the lead as China’s main soybean trading partner. The United States percent share of China’s total imports increased from 22.1 percent in 2012/13 marketing year (MY) to 36.8 percent in 2016/17, however the share declined to 28.7 percent in 2017/18. In contrast, Brazil’s share has steadily grown from 29.1 percent in 2012/13 to 58.2 percent in 2017/18 (USDA-FAS GAIN report March 22, 2019) (see Figure 1).

China’s 2018/19 soybean imports are forecast down 297 million bushels to 3.160 billion bushels year-over-year in USDA’s May 2019 WASDE report. The lower import projection is mainly due to the outbreak of African Swine Fever (ASF) in China, which has caused lower feed demand. China began publicly reporting ASF in August 2018 (USDA-FAS GAIN March 11, 2019). The ASF outbreak has been detected in all commercially important swine and pork production Chinese provinces and is expected to persist for an extended time.

China’s added 25 percent retaliatory tariff on U.S. soybeans has resulted in further substantial declines in U.S. soybean shipments to China this marketing year. China has continued to rely more on soybean imports from other markets, particularly Brazil. Given the current market conditions, the upward trend of Brazil’s share in China’s soybean imports is expected to continue this marketing year.

Although the ASF outbreak is restraining China’s overall feed demand, demand for soybeans is projected to slightly grow in 2019/20. China’s production of alternative animal proteins, particularly chicken, is supporting this expansion. The 2019/20 MY forecast is up 1 percent to 3.197 billion bushels from the 2018/19 projection, but down 7.5 percent from the 2017/18 estimate (3.457 billion bushels) (USDA (WASDE May 2019)).