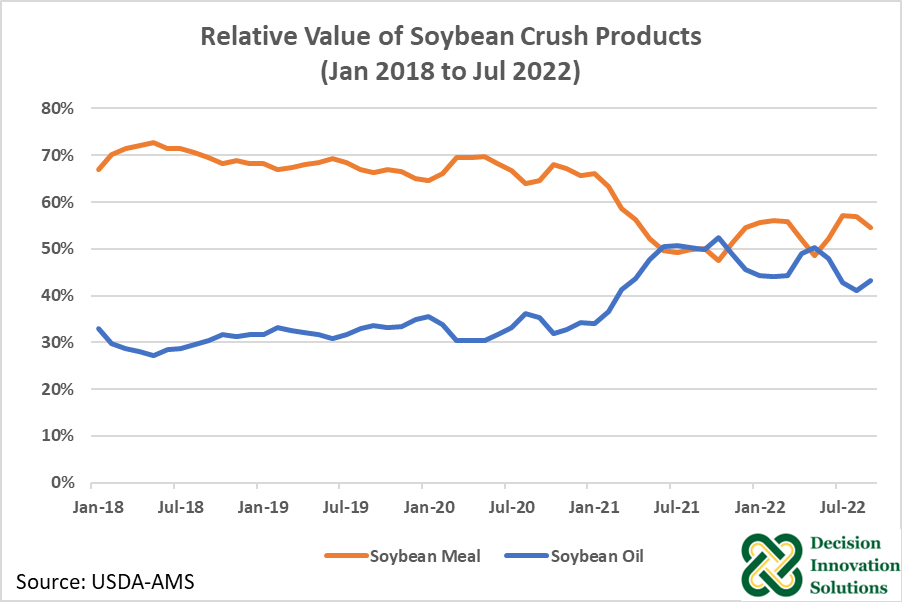

Changes in the Relative Value of the Soybean Crush

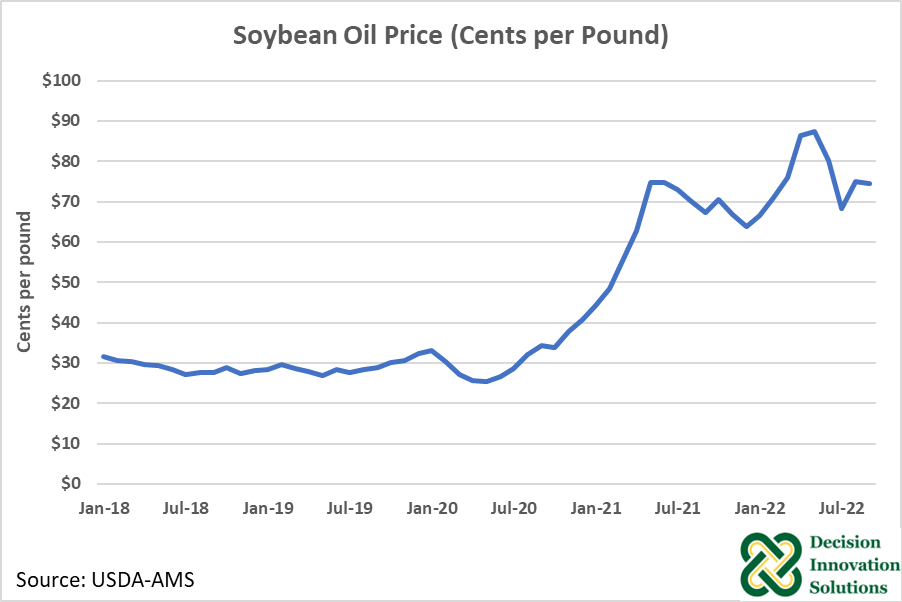

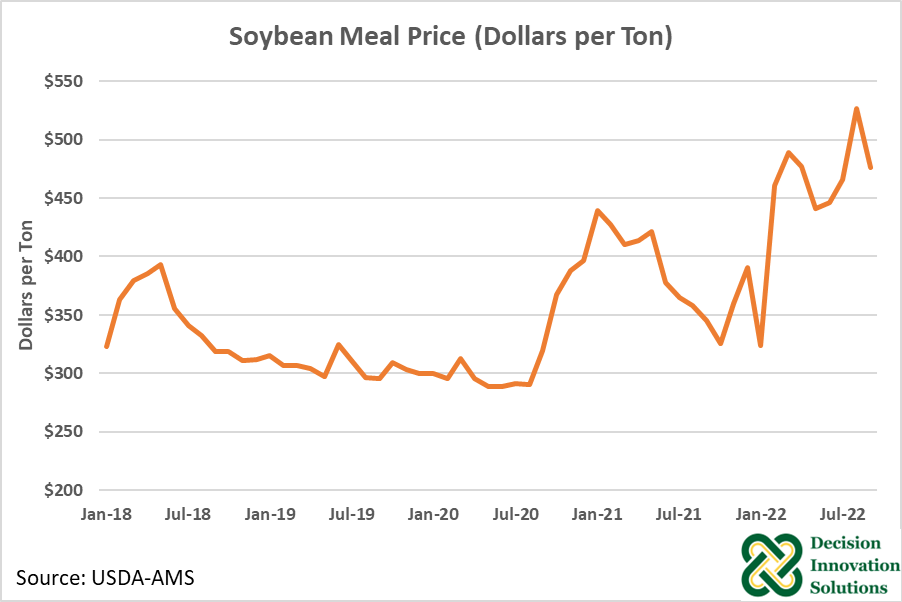

The soybean crush produces two major products, soybean meal and soybean oil. Historically, a little over 2/3 of the total value of soybean crush products came from soybean meal and the remaining 1/3 came from soybean oil (Figure 1). In Jan 2021, soybean oil began gaining ground on soybean meal, and soymeal and by the summer of 2021 the products each made up ½ of the total value of the crush. This was primarily due to large increases in the price of soybean oil. Soybean oil prices hit almost $0.90 per pound earlier this summer, after hovering around $0.30 per pound from 2018-2020 (Figure 2). Soybean prices have since cooled off, now around $0.75 per pound, while soybean meal prices have gained some ground (Figure 3). This has shifted the relative value of soybean oil down slightly, to around 45% of the value of crush, but soybean oil still makes up a much larger percentage of the total crush value than it had historically.

Figure 1. Relative Value of Soybean Crush Products

Figure 2. Soybean Oil Price (Cents Per Pound)

Figure 3. Soybean Meal Price ($ Per Ton)

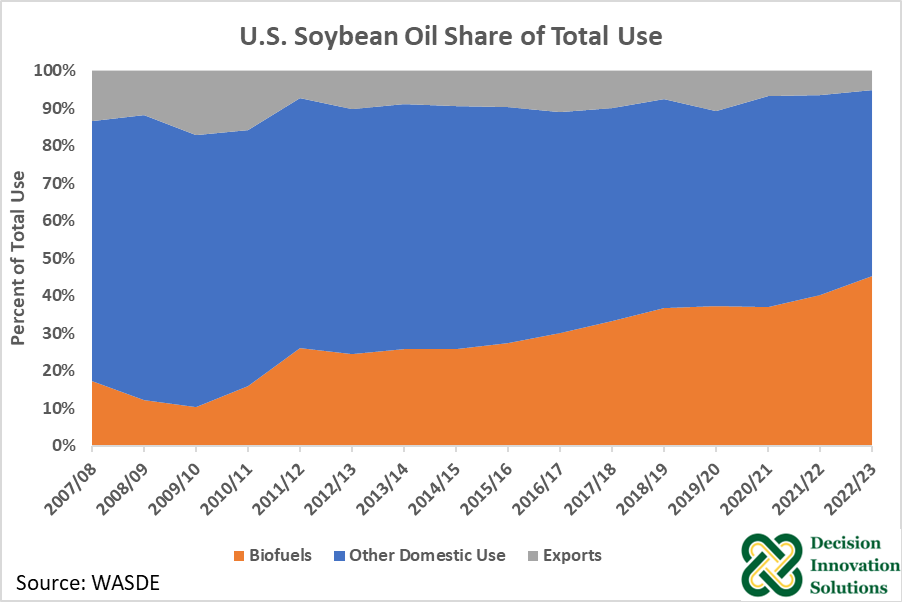

The primary reason for the increase in the price and relative value of soybean oil, is the increased demand from the biofuels industry. The production of biofuels made from soybean oil as substitutes for diesel fuel are increasing, the most notable being renewable diesel fuel. The percentage of domestic soybean oil used for biofuels has increased approximately 10 percentage points from 2015 to 2020 and is estimated to increase another 10 percentage points from 2020 to 2022 (Figure 4).

Figure 4. U.S. Soybean Oil Share of Total Use

Soybean crush is expected to increase in the coming years with much of this increase in domestic crush driven by a desire to have more soybean oil available for domestic biofuel production. Including expansions and new plants, plans for a total of 430 million bushels of additional crush capacity have been announced with 85 million bushels of the expanded capacity slated for locations in Iowa. Total soybean crush for 2022 is estimated to be 2,255 million bushels. An additional 430 million bushels of crush capacity would create 2.3 million metric tons of soybean oil and 9.0 million metric tons of soybean meal.

The growing biofuels industry provides a market for additional soybean oil, but the market for additional soybean meal produced is not yet obvious. Domestically, most soybean meal is fed to livestock, and large growth in U.S. livestock numbers is not expected in the coming years. Increased meal supply could spell trouble for future soybean meal prices, and price of other feeds as well.

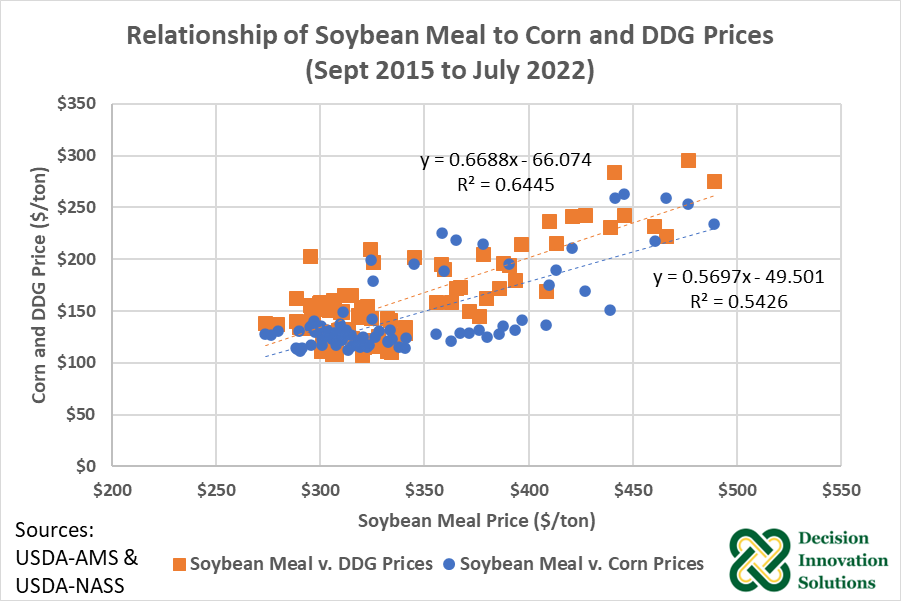

Most directly, reduced meal prices typically lead to lower prices for soybeans. But other feeds could also be affected. Prices for soybean meal and DDGs typically move together as both are feeds primarily fed for protein. The corn market could also be affected as DDG is a byproduct of corn ethanol production.

Figure 5 plots both the price of DDGs and corn against the price of soybean meal. The trendlines indicate a $1 dollar decrease in the price per ton of soybean meal is associated with a $0.67 per ton decrease in price per ton of DDGs and a $0.57 per ton decrease in the price per ton of corn.

Figure 5. Relationship of Soybean Meal to Corn and DDG Prices (Sept 2015 to July 2022)

Additional soybean meal crush is coming. Renewable diesel will likely provide needed demand for the additional soybean oil. However, the market for new meal is not yet known. A failure to effectively market new soybean meal could lead to depressed soybean meal prices. Which could depress the price of other commodities including soybeans, DDGs, and corn.