As promised in my last blog I will be writing a few blogs about Aquaculture in the U.S. as I continue my research for one of our market analytics projects. The last blog provided an overview of changes in U.S. Aquaculture over the five-year period between the 2013 USDA Census of Aquaculture and the 2018 USDA Census of Aquaculture. This focus of this blog and others will be on individual species of seafood raised in the U.S.

Sales numbers can be misleading because the price per pound may have changed over a period, but the units sold in either lbs. or head may have also changed as well. To get a more accurate view of the changes over time it is best to look at lbs. sold, or head sold (when that information is available). However, the challenge is the lack of information on some species because there may be only one or two producers of a specific species in a given state. In those cases, USDA will not publish the numbers for that state to avoid identification of the producer(s). In most cases at least the U.S. total is available.

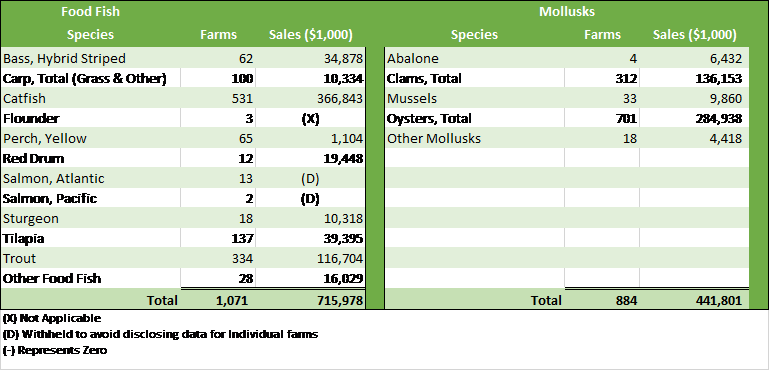

The following tables provide a summary of the number of farms and the total sales by species for the major species groups. Please keep in mind that sales by themselves make comparison difficult. The price per pound varies considerably by species.

The highest volume group is Food Fish. In Table 1 the two highest sales volumes are Catfish and Trout. These are the only two species that are tracked and reported on annually. Yellow Perch production has fluctuated widely. From my own view point it appears that the recirculating aquaculture systems (RAS) operations are the most successful because diets are better controlled and there is less exposure to disease.

The next highest group in sales volume is the Mollusks group. The two most significant species are Clams and Oysters.

Table 1 Food Fish- Mollusks

The next highest sales volume species group, shown in Table 2, is Crustaceans. Crawfish and Shrimp are the two leaders in that group. There are some developments in saltwater shrimp product located in Minnesota, Iowa and South Dakota. At this point it is a little too soon to tell if they will be successful. The drivers seem to be availability of water and being closer to the supply of major ingredients for feeding the shrimp.

Table 2 Crustaceans and Ornamentals

The final two species categories, shown in Table 3, are baitfish and sport fish. Both of these groups are focused on supporting recreational fishing. The sport fish are typically sold for stocking lakes and streams.

Table 3 Baitfish and Sport Fish

This has been a brief overview of sales volumes by species of aquaculture in the U.S. My next blog will address the catfish and trout production industry with a focus on opportunities and challenges for producers, feed manufacturers and processors.