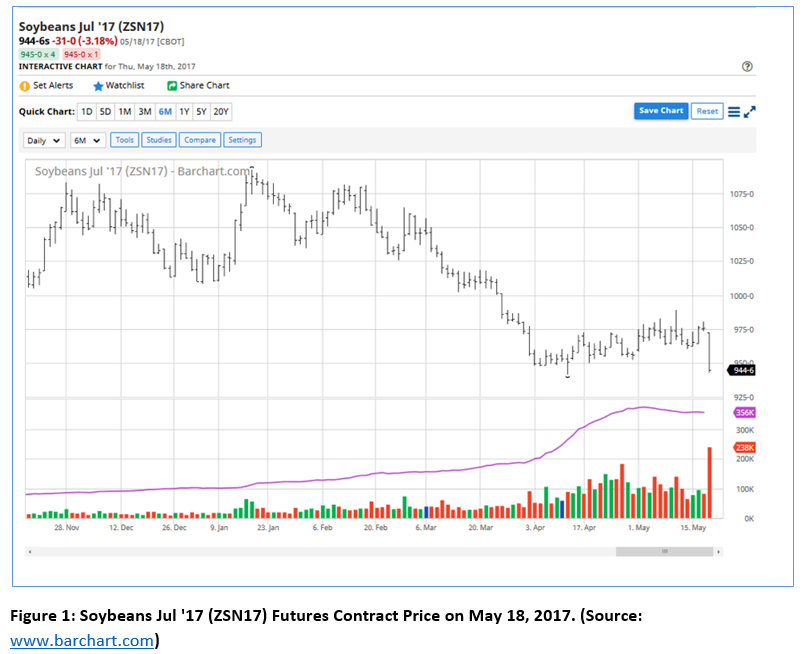

Brazil’s government scandal brought its currency, the Real, down approximately 7 percent within the last 24 hours. This large drop in the Brazil’s currency has made U.S. soybean uncompetitive and less attractive in the international soybean market. As shown in the Figure 1, this news seems to be the main reason behind the selling that broke down the soybeans charts last night (May 17, 2017).

Political crisis in Brazil started with a report on Wednesday (05/17/17) that there is a taped conversation between Brazilian President and jailed former House Speaker about payments in return for his silence. Soybean futures are trading mostly 30 cents lower currently due to the lower Real. Concurrently, soybean farmers in Brazil are finishing up the soybean harvest. This is the time when we see long lines of trucks taking soybeans to the ports and long lines of vessels waiting to be loaded. With the significant drop in currency values and plenty of soybeans available, Brazil’s soybean exports will likely increase dramatically. This will force US soybeans sharply lower to remain competitive in the export market.

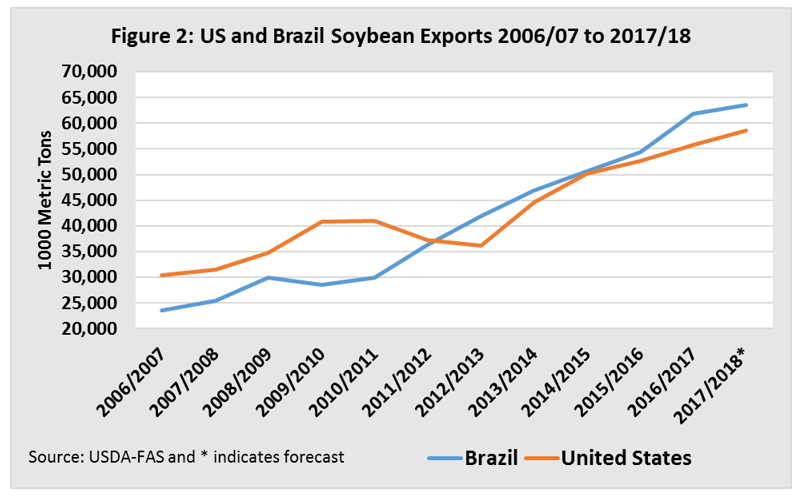

Brazil’s soybean production is forecast to be 111 million metric tons in 2016/17, compared to United States production of 117.2 million metric tons. The Brazil production forecast in 2016/17 is an increase of 15 percent, compared to 96.5 million metric tons during the 2015/16 period. However, Brazil is the world largest soybean exporter as shown in Figure 2. Brazil became the largest exporter surpassing the United States after 2011/2012 marketing year. Any impact on the Brazil soybean market has tremendous implications for the U.S. market and the world as a whole.