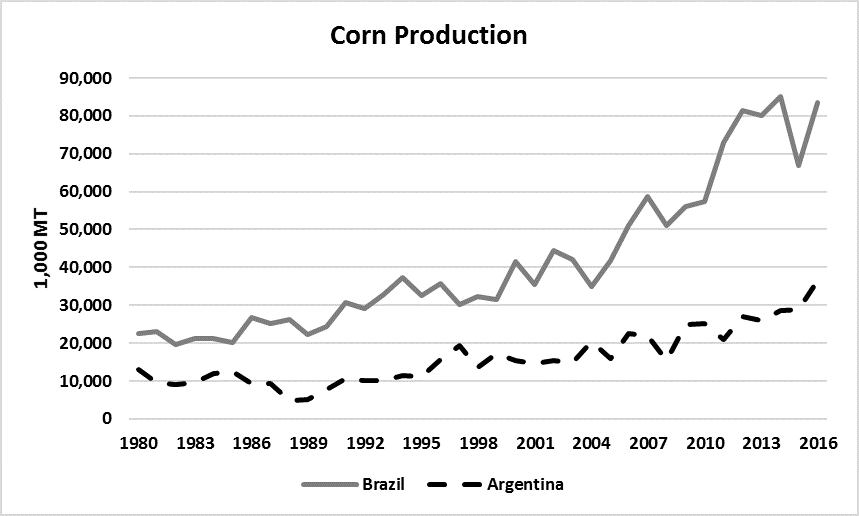

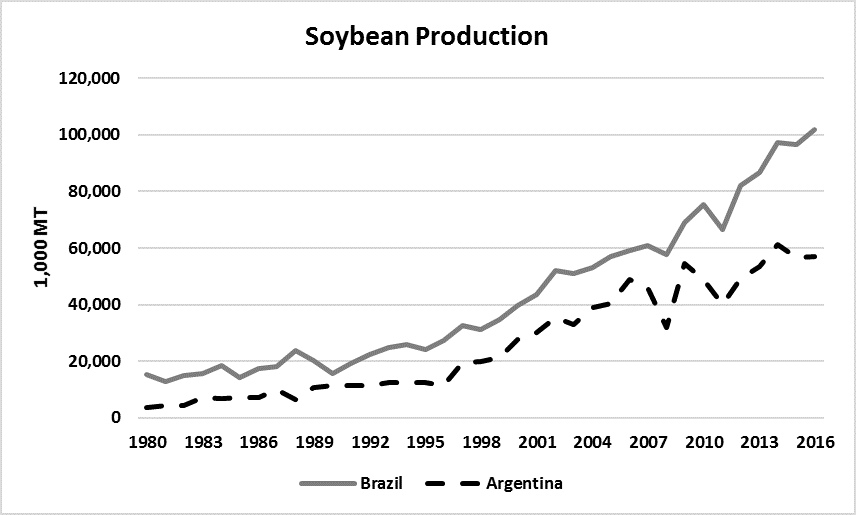

Brazil and Argentina play a large role in world corn and soybean markets. Brazil has seen a significant rise in corn production over the past 10 years, and soybean production has also been increasing steadily since about 1996 in both of these countries.

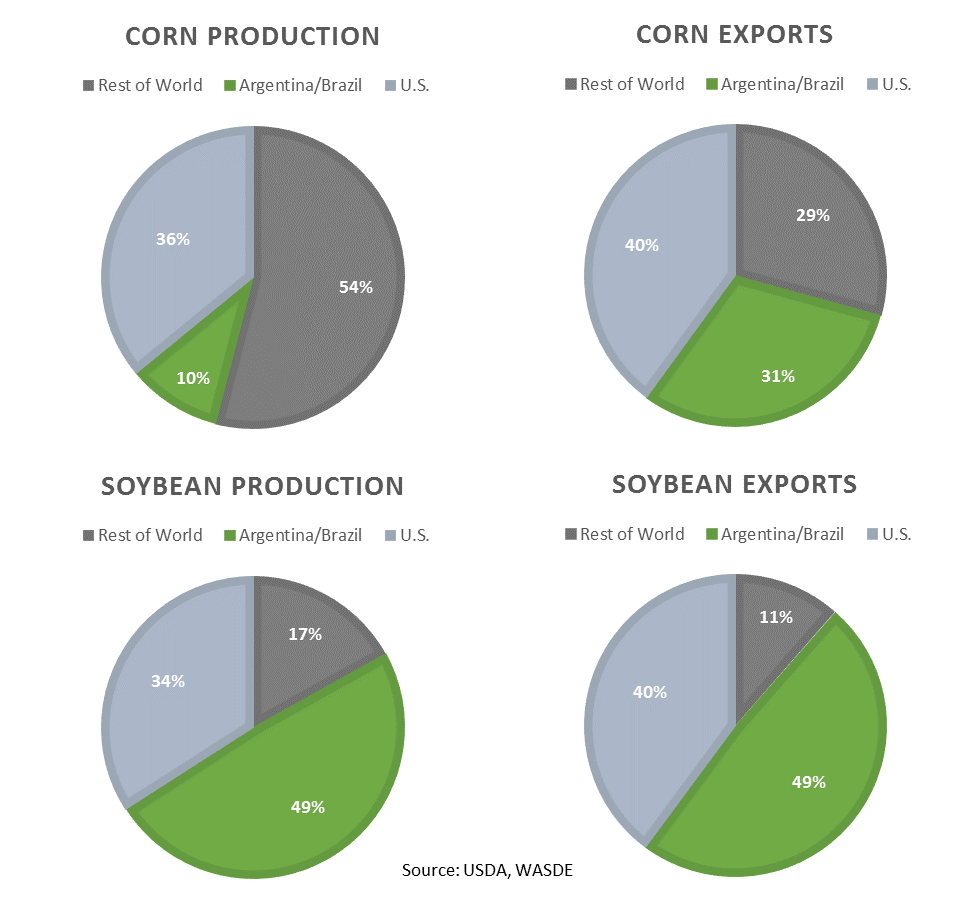

As you can see in the pie charts below, Brazil and Argentina contribute nearly half of the world soybean exports, and they are also relied on heavily in the corn export market.

The U.S. leads the way in corn production at about 54% of the world total, and Argentina and Brazil combine to add about 10%. The world corn export market sees about 40% come from the U.S., 31% from Brazil and Argentina, and the remaining 29% from the rest of the world.

According to the November WASDE report, U.S. and Brazil were the top leaders in the world for soybean production at 106 and 96 MMT, respectively. Argentina and Brazil combine to make up 49% of the world’s soybean production and the U.S. adds 34%, leaving the rest of the world to contribute about 17%. For the 2015/16 marketing year, Brazil is expected to be the leading exporter of soybeans at 54 MMT, and the U.S. coming in a close second at nearly 52.6 MMT. When combined, Argentina and Brazil make up about 49% of total soybean exports, 40% comes from the U.S. and the remaining 11% comes from the rest of the world. This shows how heavily the world relies on soybeans from Brazil, Argentina, and the U.S.

The Argentine peso has seen a significant decline since 2008, going from about 0.33 to 0.06 compared to the U.S. dollar. The Brazilian real was about 0.65 to a U.S. dollar in 2011, but then fell to a low of 0.24 in 2015. Since then, it has been strengthening and is currently 0.30 to the U.S. dollar.