U.S. pork exports have been facing a series of challenges over the last few months that have resulted in reduced volume of exports during August and September. As indicated by the U.S. Meat Export Federation, higher pork prices by the end of July, Russia's pork import ban starting during the first week of August as well as a strong U.S. dollar played some role in the decline of pork exports. Despite these reductions, U.S. pork exports this year (January to September) are 3% ahead compared to the same period last year reaching a volume of exports of about 1.26 million metric tons (See Figure 1).

Considering the first nine months of 2014, the largest exports were registered in the month of March, reaching 161,858 metric tons. In contrast, September exports were the lowest exports of the 2014 year with a volume of 117,749 metric tons.

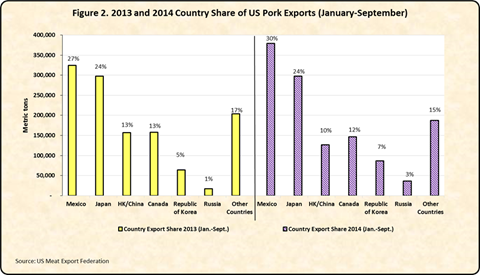

Mexico and Japan have been the main export destinations for U.S. pork, with Mexico leading U.S. pork export growth since 2012. During the first nine months of the year these two countries have received 54% of the volume of exports while 29% of exports have been shipped to China/Hong Kong, Canada, and Republic of Korea (South Korea) (see Figure 2).

Overall, exports to China/Hong Kong have been decreasing since May 2014 due to China's falling hog prices and increased domestic supplies. However, some of the losses in this market have been partially offset by the expansion of the South Korean market whose high domestic pork prices have been spurring the increase in U.S. pork exports to that country during this year.

In the Central-South America region, Colombia is the main U.S. pork export destination with a total export volume of 33,901 metric tons this year, representing a 67% increase compared to last year (20,303 metric tons).

Looking ahead, U.S. pork exports are projected to grow next year. Recent USDA projections indicate a 5% increase in U.S. pork production to 10.9 million tons (CWE). The forecast indicates larger farrowing, as well as a production recovered from the negative impact of Porcine Epidemic Diarrhea (PED) bringing a gradual increase in the number of pigs per litter. In addition, with projected lower feed cost, production of heavier weight pigs is expected. An increased supply and lower prices will boost U.S. exports which are projected to grow 3 percent to 2.4 million tons.