Sustainable Aviation Fuel for the Future

Sustainable Aviation Fuel (SAF) production provides a substantial opportunity for Midwestern states, Midwestern farmers, and Midwestern renewable fuel producers to prosper in the coming years if the SAF Grand Challenge comes to fruition and the Midwestern states take steps to be active participants in making the Roadmap come to life.

The pathway that DIS estimates most likely to be realized has HEFA- based SAF and ethanol-to-jet (ETJ) being the two most prominent pathways for SAF production at least for the next 20 years. SAF from HEFA, ETJ, and PTF-corn CO2 are expected to be more than 90% of SAF production in 2026, around 80% of SAF production in 2030, and still more than 70% of SAF production in 2043 before the eventual development of PTF-SAF from direct air capture and renewable hydrogen kick in for the final push to 100% SAF adoption by 2050.

But, this potential cannot be fully realized without Carbon Capture and Sequestration (CCS) for ethanol. And, without the potential new use for corn for ETJ-SAF, the U.S. corn supply is and will continue to grow at a pace that outstrips demand. Either stocks will build, and prices will decline, or a significant amount of corn acreage will need to be pulled out of production.

Furthermore, the urgency of facilitation of CCS for ethanol becomes even greater if Electric Vehicle (EV) adoption happens more rapidly than projected by the current Energy Information Administration (EIA) baseline. Time is of the essence and the clock is ticking.

The Challenge

To fully realize the potential for SAF production, there is an opportunity to develop 12 billion gallons of additional ethanol production with more than 90 percent of that new production in the Midwest to go along with the current ethanol production capacity that supports domestic ethanol blending (more than 14.8 billion gallons projected by EIA to be blended for light vehicle use in 2050).

The Solution

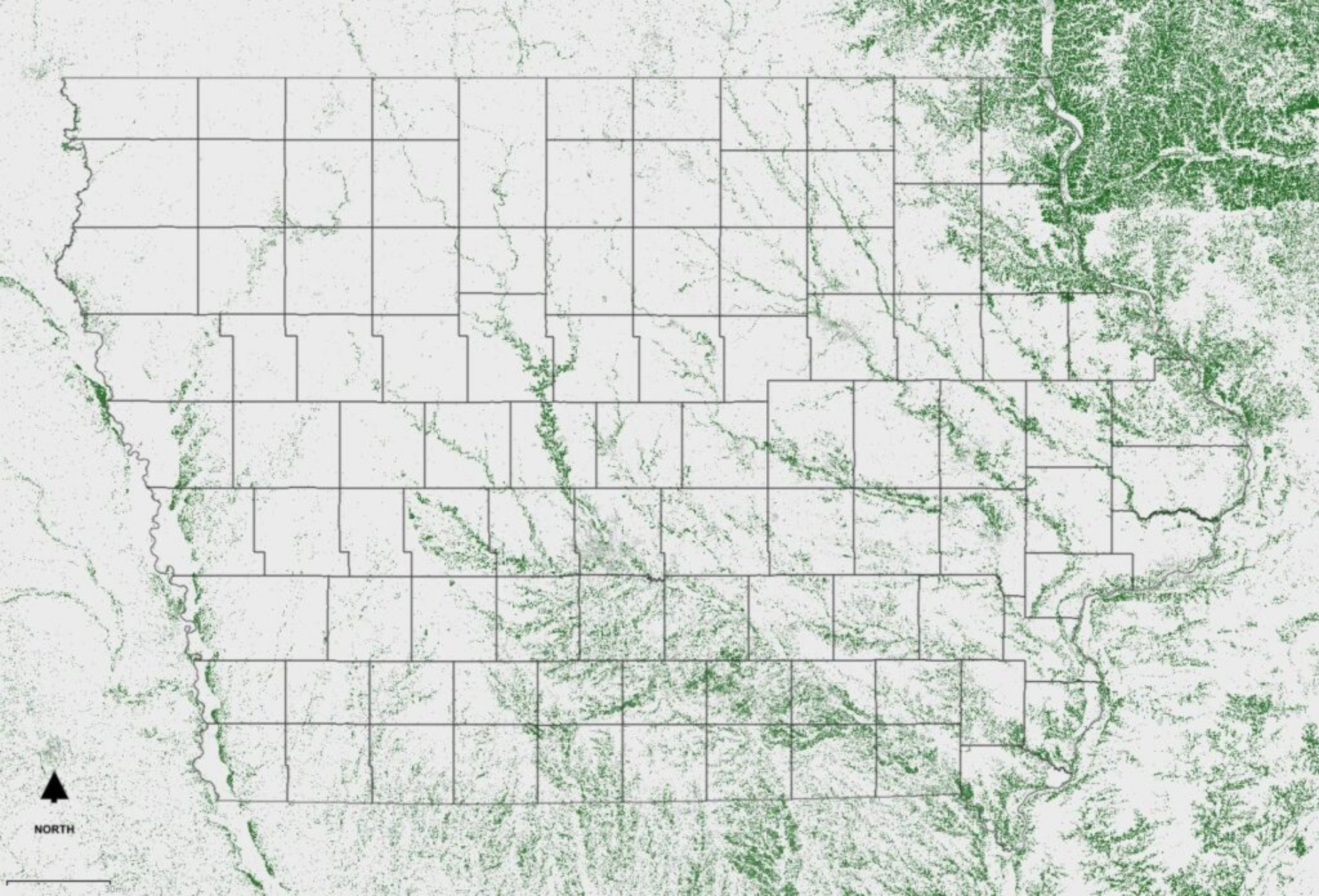

Building out CO2 capture and sequestration via pipeline could have substantial positive impacts across the Midwest. While the trunkline and 31 connected plants are estimated to generate $5.1 billion in

construction impacts, the eventual addition of 33 more plants to that trunkline are estimated to add another $2.58 billion in construction impact.

The Results

Annual operations of the combined carbon collection and sequestration activities are estimated to be

$256 million with gross economic output of $568 million with 3,499 jobs and $146 in annual federal, state and local taxes being generated.