Last November 30, the EPA published its final rulemaking for the 2014-2017 time period of the Renewable Fuel Standard (RFS), which was enacted in 2007. The biodiesel mandate was slightly increased compared to the preliminary proposal released on May 29, 2015. The volumetric requirements for 2014, 2015, 2016, and 2017 are 1.63 billion gallons, 1.73 billion gallons, 1.90 billion gallons, and 2.0 billion gallons respectively. The biodiesel fuel standard is enforced through the trading of D4 RINs. The D4 RIN is used by the EPA to track biodiesel trading by assigning a unique RIN to each gallon of biodiesel that is produced. However, D4 RINs differ from ethanol (D6) RINs in that a D4 RIN is worth 1.5 of the ethanol (D6) equivalent. D4 RINs are traded in the RIN market, thereby attaching monetary value to incentivize biodiesel production. EPA provides aggregated monthly data on RINs (price and quantity traded) and fuel production through EPA Moderated Transaction Systems (EMTS).

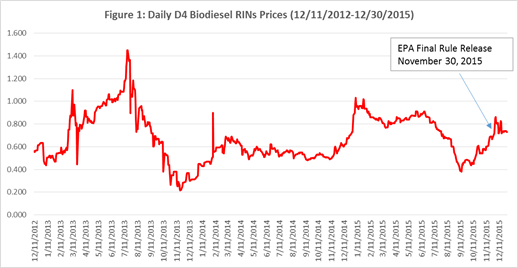

Biodiesel D4 RINs theoretically represent the marginal cost of complying with the RFS. How do we understand recent behavior of D4 prices (see Figure 1) as it relates to determining the price of D4 RINs? It turns out that there are three major factors that affect the price of D4 RINs.

The first one is the price of biodiesel feedstocks. The price of feedstocks is the main driver of the cost of producing biodiesel and therefore a key determinant of biodiesel price. Conceptually, lower feedstock prices will increase the price of D4 RINs; conversely, higher feedstock prices will decrease the price of D4 RINs. For example, lower soybean oil prices will decrease the cost of producing biodiesel and in turn can trigger relatively higher RIN prices.

The second factor that determines the price of D4 RINs is the blender's tax credit. Conceptually, assuming all others factors are unchanged, reinstating the biodiesel tax credit can decrease the price of D4 RINs. Note that blenders initially bear the cost of complying with the mandate in the biodiesel market, but the tax credit will partially offset the compliance cost, thereby reducing the D4 RIN price. EPA reinstated the blenders' tax credit retroactively for 2014 and 2015 and extended to 2016 in the final rule making on last November 30. This will soften the price of D4 RINs assuming all others factors are unchanged.

The third factor that determines the price of D4 RINs is the volumetric mandate. The higher the volumetric equipment, the higher the price of D4 RINs and vice versa.

In conclusion, understanding the behavior of D4 biodiesel RINs is very important in the current renewable fuel market place because D4 RIN prices drives D6 ethanol RIN prices when the ethanol mandate exceeds the blend wall.